In Nigeria’s oil fields, international giants have pumped crude for decades – yet the country struggles to develop its own refineries or high-tech industries. In Mexico, global car companies churn out vehicles for export, but local suppliers and engineers remain stuck making low-value parts. Stories like these reflect a troubling pattern across the developing world: foreign capital pouring in, while domestic capabilities stagnate or even erode.

Policymakers in poor and middle-income countries are often told that attracting foreign investors is key to prosperity: inflows are treated as a ‘vote of confidence’ and their decline as a sign of distress. According to this dominant narrative, capital naturally flows to places where it’s needed most, bringing not just money but advanced technology and managerial expertise in its wake. By this logic, if investors hesitate to come, the fault lies in the host country’s policies or politics. In our era of globalisation, foreign investment is heralded as a lifeline for developing economies – a reflection of economic strength and a driver of future growth.

Yet history tells a more complicated story. Some of the world’s most successful economies rose to prosperity by keeping foreign capital on a tight leash. South Korea and Taiwan, for instance, leveraged foreign money and know-how on their own terms, ensuring it aligned with national priorities. Even the United States and Japan – today’s wealthy giants – were once very cautious about foreign investment on their soil. The US was one of the largest recipients of foreign capital in the 19th and early 20th centuries, but it imposed strict rules on foreign investors, especially in banking, shipping, natural resources and other strategic sectors. Japan went even further, tightly regulating foreign business to protect and nurture its domestic industries. These countries didn’t simply throw open the doors. This historical lesson suggests that, while foreign investment can be a tool for development, it works only when a country retains control over how that capital is used and ensures the benefits are captured at home.

Beginning in the 1980s, however, a different approach to foreign capital took hold across much of the Global South. Influenced by a resurgence of free-market ideology, Washington institutions – in particular the IMF and the World Bank, backed by the US Treasury – urged (and often pressured) developing countries to ‘liberalise’ their economies: privatise state industries, deregulate markets, cut tariffs, and welcome multinational corporations with open arms. Sir Leon Brittan, a former European trade official, captured the era’s optimism in 1995 when he proclaimed that investment was finally ‘recognised for what it is: a source of extra capital, a contribution to a healthy external balance, a basis for increased productivity, additional employment, effective competition, rational production, technology transfer, and a source of managerial know-how’. In other words, foreign capital was seen as an unambiguous good – a panacea for development.

The US trade representative Mickey Kantor signing the final measure of the Uruguay Round of the General Agreement on Tariffs and Trade in Marrakech, 1994. Photo © WTO

Under this gospel of globalisation, international agreements were also locked in a kind of one-size-fits-all openness. In the 1990s, the Uruguay Round created the World Trade Organization (WTO), a club of governments that writes common rules for trade and runs a court-like system to settle disputes. Two of its agreements mattered a lot for foreign investment. First, the Agreement on Trade-Related Investment Measures (TRIMs) says countries cannot use certain investment conditions that interfere with trade in goods. The most well-known example was the practice of demanding that foreign firms buy a set share of inputs (the parts, raw materials and services it needs to produce) from local suppliers (‘local content’). Other common demands, like making a foreign company partner with a local firm (a joint venture) to promote technology transfer, are not directly banned by TRIMs. In practice, however, they’ve become harder to sustain because firms can challenge them as discriminatory or as back-door restrictions on imports. Second, the General Agreement on Trade in Services (WTOS) sets the rules for services such as banking, telecoms and transport. To participate fully in GATS, a developing country generally cannot cap foreign ownership or require joint ventures.

For many developing economies, the result was a narrower policy toolkit than earlier success stories had used. Local-content and trade-balancing rules in manufacturing were taken off the table by TRIMs, and, where governments scheduled GATS commitments, ownership caps and joint-venture requirements in services became hard to defend. By the beginning of this century, many poor and middle-income countries had, in effect, lost control of foreign investment in their economies. They had opened up on the promise that foreign capital was by definition good for growth, only to find themselves constrained from steering that investment toward national development goals.

A country can host modern factories and still not acquire the capacity to create its own Nokia or Toyota

In a path-breaking book called The Rise of ‘The Rest’ (2001), Alice Amsden studied how a group of late-developing countries – including South Korea, Taiwan, China, India, Brazil, Mexico and others – managed to industrialise after the Second World War. These countries, which she called ‘the Rest’, typically began by importing or imitating technology from more advanced nations, rather than inventing it themselves. They built up basic manufacturing industries by leveraging know-how borrowed from abroad, creating modern factories often without proprietary innovations of their own. This strategy worked up to a point, fuelling impressive growth, but it could carry a country only so far. According to Amsden, the history of these countries tells us that, to climb from middle-income status to a truly advanced economy, a nation would eventually have to develop its own technological capabilities instead of relying indefinitely on foreign technology. In other words, the ladder that got you out of poverty – assembly plants, foreign machinery, off-the-shelf technology – would not by itself get you into the top tier. Sustained development required a transition from reliance on imported know-how to home-grown innovation. This transition, Amsden pointed out, is very hard. Why?

Amsden highlighted the problem of knowledge-based assets – the skills, expertise and design know-how that allow firms to produce complex products efficiently. To protect their competitive advantage, multinational corporations guard these assets fiercely. Much of this valuable knowledge is also tacit – in other words, difficult to fully codify or transfer in a handbook or a brief training session. So even when foreign firms set up operations in a developing country, some of the most valuable knowledge – key design skills, engineering tricks and management practices – often remain locked inside the foreign firm’s enclave. The result is a kind of glass ceiling on development: a country can host modern factories and still not acquire the capacity to create its own Nokia or Toyota.

In Latin America, many industries – especially those requiring advanced technology or large upfront investments – ended up dominated by foreign multinationals. In the 1980s and ’90s, Brazil, Mexico and Argentina opened their markets without strong safeguards for domestic industry. The immediate effect was a surge of foreign-led production. Local firms were often crowded out of these high-tech or capital-intensive sectors and relegated to simpler, low-value activities.

The first all-wheel-drive Kia Sportage to be built in Germany rolls off the production line in Osnabrück in April, 1995. Photo by Ingo Wagner/picture alliance/Getty

In contrast, several 20th-century East Asian countries took a very different path. South Korea, Taiwan and later China welcomed foreign capital, but selectively, and they retained domestic control over strategic industries. The East Asian governments encouraged joint ventures and imposed performance requirements on multinationals – insisting they share technology or use local suppliers – while aggressively supporting home-grown companies. In South Korea, for example, the state nurtured its own automotive champions (like Hyundai and Kia) behind protective barriers, instead of simply opening the floodgates to foreign carmakers. In Brazil, by comparison, the automobile market was dominated for decades by overseas giants with few linkages to local suppliers. The outcomes have been very different. South Korea and Taiwan managed to develop robust mid- and high-technology industries and even create ‘domestic multinationals’ of their own. When crises struck – such as the developing-country debt crisis of the 1980s – these East Asian nations proved more resilient and recovered faster, having built up their own industrial base. By contrast, Latin American countries, lacking a strong domestic technological footing, struggled to compete and to escape their dependence on exporting basic commodities or low-tech goods.

The Hyundai Pony, South Korea’s first mass-produced car, debuted in 1975. Courtesy Hyundai

The idea that who owns the capital matters for development is not new. In the mid-20th century, economists from the Global South had warned about the dangers of unchecked dependence on foreign capital. Raúl Prebisch and Celso Furtado, working in Latin America, observed that developing countries tend to export low-value raw materials and import high-value manufactured products. This unequal exchange, Prebisch and Furtado saw, keeps poor nations poor. Flooding a primary-product economy with foreign capital, they argued, could perpetuate this imbalance. Without pro-development policies, foreign investors would gravitate to the easiest profits, often in minerals, oil or agricultural staples, reinforcing a country’s role as a provider of commodities and a consumer of finished goods. In the 1970s, the Chilean economist Osvaldo Sunkel highlighted a dual economy in developing nations, with capital-intensive sectors dominated by multinationals, while local firms remain in low-productivity areas. Sunkel argues that this segmentation worsens inequality and undermines local technology. With local firms excluded from dynamic sectors, opportunities for innovation and skills development diminish. Sunkel also noted that foreign companies often repatriate profits instead of reinvesting locally. In the 1990s, foreign banks in Argentina sent significant profits abroad, worsening the country’s balance-of-payments crisis. This profit drain makes host countries vulnerable, as export earnings leave the country as remittances.

These economists from the Global South formed a clear message: foreign capital is a double-edged sword. Yes, it brings investment and can jump-start industries, but without clear conditions and a well-defined strategy, it can trap a nation in an early stage of development.

A surge of foreign competitors can knock out local industry rather than lift it up

Recent research suggests that this development trap has been borne out on the ground. One crucial factor is the education and skill level of the local workforce – the human capital. Studies find that if a country lacks sufficiently skilled workers, foreign investment does little to boost the economy and can even have negative effects. For example, in sub-Saharan Africa, multinational companies have frequently invested in manufacturing or resource extraction, but with meagre benefits for the host country because there were too few trained local engineers or technicians to absorb the new technologies. The foreign firms ended up operating as garrisons of modernity with expatriate expertise, disconnected from the domestic economy. Economists call this ‘absorptive capacity’: without a baseline of education and infrastructure, a host nation simply can’t absorb the knowledge that foreign investors bring, and the presence of a multinational might not help and could hurt – for instance, by outcompeting and shutting down the few domestic firms that do exist, without generating broader gains.

Another factor that influences the effect of foreign direct investment (FDI) on the host economy is the strength of local businesses and financial systems. If domestic companies are fragile or banks are weak, a surge of foreign competitors can knock out local industry rather than lift it up. In a 1999 study of Venezuela, the economists Brian Aitken and Ann Harrison demonstrated that, when foreign firms entered an industry, the productivity of those foreign-owned plants went up – but the productivity of domestically owned plants in the same industry went down. In essence, the multinationals took the most productive slice of the market and enjoyed efficiency gains, while local firms lost business, invested less or even closed, dragging down overall progress. This kind of crowding-out effect is more likely in countries with poorly developed financial markets, where local entrepreneurs struggle to get credit. A big foreign company can often secure loans and dominate supply chains, sucking up the oxygen that local firms need to grow.

Foreign investment can also reshape market structure in ways that limit long-term development. A detailed study by Laura Alfaro and Maggie Chen in 2018 found that, when multinationals enter new markets, they often force domestic firms to abandon certain product lines or market segments, leading to highly concentrated industries. In some cases, the entire sector ends up focused on a narrow range of activities tailored to the foreign giant’s needs. This specialisation might make a few remaining local players more efficient, but it reduces diversification and leaves the economy overly dependent on a handful of low-value activities. Meanwhile, other research by Manuel Agosin and Roberto Machado in 2005 found that, in countries in Africa, Asia and Latin America, FDI tended to replace domestic investment rather than supplement it, aggravating structural weaknesses.

The short-term outcome in many underdeveloped countries has shown that when multinational corporations arrive, they (1) increase competition and wipe out less productive local firms; (2) concentrate market power in their own hands; (3) reinforce a low-skill equilibrium (hiring workers for basic tasks does not incentivise higher education); and (4) push the economy to specialise even more in low-value-added goods. These effects might yield some short-term efficiencies and consumer benefits – cheaper goods, perhaps temporarily more jobs – but they carry a hidden long-term cost. The country’s industrial structure becomes narrower and hardens around its static comparative advantages (like textiles, basic agriculture or assembly work), instead of evolving toward new, higher-value economic activities.

To investigate the long-run impact of foreign capital on development, I recently conducted an empirical study spanning several decades. I focused on a simple measure: the share of a country’s productive assets that were foreign-owned around 1980 (the stock of FDI as a percentage of GDP), and then looked at how that country’s economy performed over the next 40 years. Even after accounting for other factors like initial income, institutions, education and geography, countries that had a higher foreign capital share in 1980 experienced significantly slower income growth by 2019. In fact, the analysis suggests that, for low-income countries, an increase of 1 percentage point in the FDI-to-GDP ratio in 1980 was associated with roughly a 1.3 per cent lower GDP per capita by 2019. Let’s consider Chile versus China. In 1980, Chile’s economy had a very large foreign stake – its FDI stock was about 35 per cent of GDP – whereas China was essentially closed to FDI, with a foreign share of nearly 0 per cent. This difference in foreign ownership correlates with a big divergence in outcomes. If all other things had been equal, from 1980 to 2019, Chile’s per-person income growth could have been around 40 per cent lower than China’s, simply due to Chile’s heavy reliance on foreign capital and China’s reliance on domestic capital during that period. Of course, China’s spectacular rise has had many causes, but one is its strategy of setting its own terms for foreign investment.

Particularly in less-developed countries, multinationals failed to deliver the promised technological upgrading

Countries that have welcomed lots of foreign investment tend to exhibit signs of the ownership trap. They developed less complex and less specialised exports, often continuing to export mostly raw materials or simple manufactured goods. They had a higher share of low-tech exports and saw weaker growth in productivity. These economies failed to climb the ladder of industrial sophistication. The findings are consistent with other economic research: very poor countries benefit from some diversification of their economies at first, but middle-income countries progress further only if they start specialising in more advanced, high-value industries. The trouble is that heavy foreign ownership seems to anchor many countries to their initial specialities, preventing that next step. When a multinational sets up an assembly plant in a low-wage country, that country may end up specialising even more in assembly work – doing it on a larger scale for the foreign firm – rather than moving into designing its own products. High-FDI countries often found themselves producing what multinational corporations needed (cheap inputs, basic components, commodities), reinforcing a low-tech economic structure. Domestic innovation and diversification suffered because the commanding heights of the economy were held by outside firms focused on efficiency and profit, not on developing local talent or suppliers.

A conventional wisdom in economics – that ‘capital has no country’: that it shouldn’t matter who owns the factories and mines as long as they produce growth – does not always hold up. In theory, free flows of capital should allow each nation to prosper by focusing on what it does best. In practice, when foreign capital flooded relatively weak economies, it often entrenched those societies in low-value activities while siphoning off the gains. Policymakers presumed that foreign investors’ technology and management prowess would catalyse broader, and deeper, development, but often those benefits remained elusive. Particularly in less-developed countries, multinationals failed to deliver the promised technological upgrading. Yes, there were instances where efficiency in certain factories improved, or output increased after a foreign takeover. But we should not confuse those productivity jumps with genuine knowledge transfer. In many cases, the gains came from foreign firms reorganising production around what the host country was already relatively good at – say, cheap labour for garment sewing – or exploiting economies of scale by integrating the host into their global supply chain. These moves can boost output and profits, but they don’t necessarily teach the country how to make more sophisticated products or invent new technologies. A nation’s economy ends up doing more of the same, just under foreign direction.

Over time, the dynamic consequences of this arrangement can be pernicious. By confining local firms to less complex tasks, the presence of dominant foreign players reduces the incentive and opportunity for local innovation. The demand for skilled labour stays low, so the education system has less pressure to produce engineers or scientists. A cycle sets in: weak local innovation leads to few skilled jobs, which in turn curtails the capacity for further innovation. In the worst case, an economy can plateau, stuck in a middle-income trap where wages rise to a certain point but the move into higher-value industries never occurs. Instead of becoming the next South Korea, a country might remain an assembly hub for someone else’s brand – relatively industrialised but not developed.

Computer manufacturing at the Tatung Company electronics factory in Taiwan in 1992. Photo by Gérard Sioen/Alamy

Is the answer then for countries to shut out foreign investment entirely? Not necessarily – the success stories suggest a more nuanced approach. Foreign capital can aid development, but only when countries harness it strategically. The East Asian Tigers exemplified this balance. South Korea and Taiwan borrowed heavily and welcomed joint ventures, but required foreign firms to partner with local companies and transfer technology, directing capital into strategic sectors as part of broader industrial policy. At the same time, they built up domestic champions in those sectors so that foreign operations would not dominate indefinitely.

This approach echoed earlier industrial powers such as the US and Japan: leverage foreign capital, but avoid dependency. South Korea in the 1960s and ’70s licensed technology and hosted foreign factories, but always with the goal of enabling local firms to absorb knowledge and compete globally. By the 1980s, it had nurtured world-class companies in autos, steel and electronics, loosening FDI restrictions only after domestic firms were firmly established.

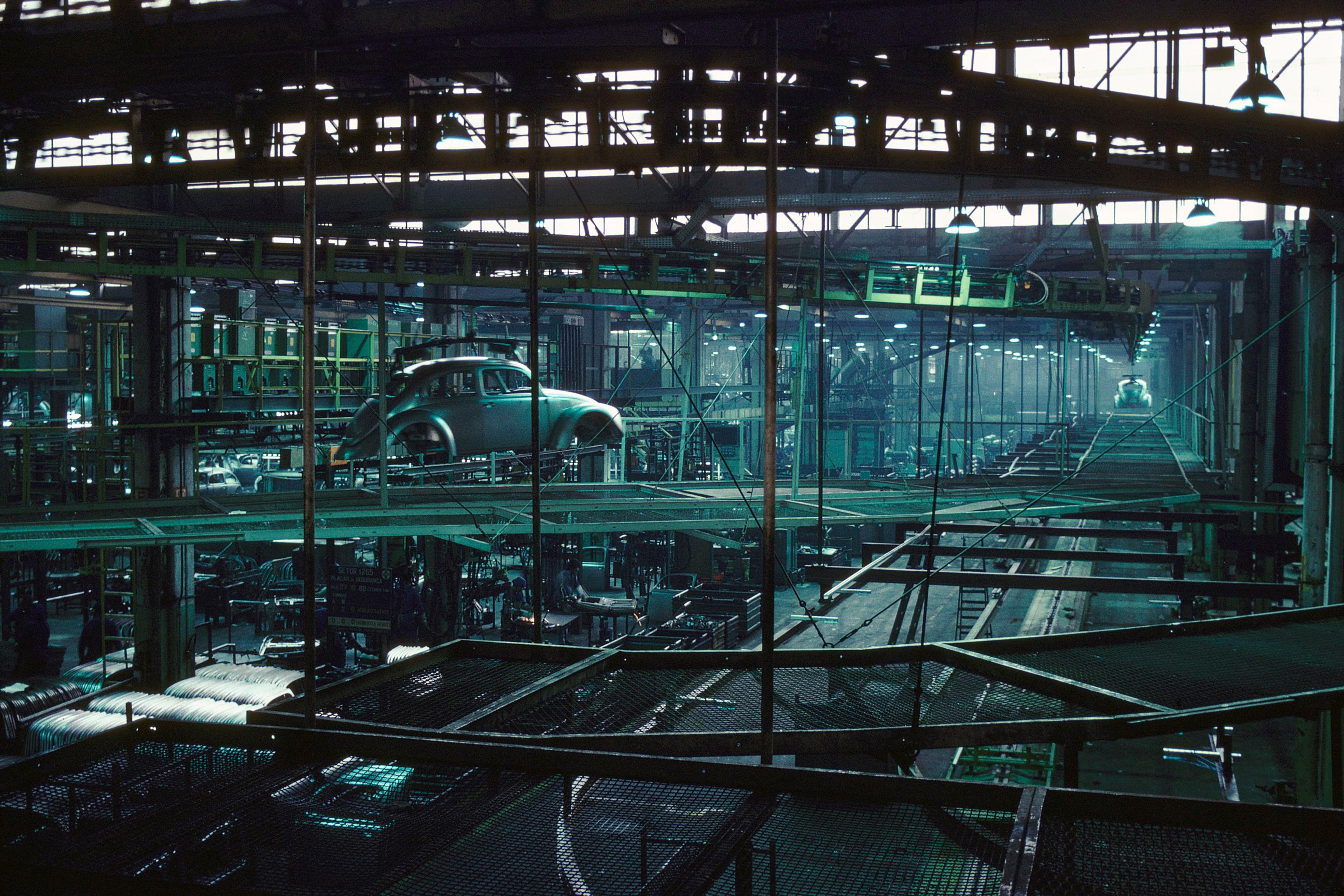

China later followed a similar template. In the 1980s and ’90s, it attracted investors with cheap labour and huge markets, but demanded joint ventures and technology transfer. Volkswagen, for instance, could enter only through a partnership with a state-owned firm. Through such arrangements, Chinese automakers gradually gained industry knowledge. Similarly, in electronics, Huawei, Lenovo and other firms emerged after years of absorbing foreign technology and investment under guided conditions.

The anti-globalisation turn in wealthy nations often comes wrapped in nativist rhetoric and can veer into xenophobia

The contrast between strategic integration of foreign capital and the laissez-faire approach is stark. Countries that actively shaped foreign investment to serve their development goals managed to climb into the ranks of advanced economies. Those who simply opened the door wide, hoping for the best, often found themselves trapped in the lower rungs of the global economy.

Ironically, even some rich countries are today voicing doubts about unfettered capital flows – though for very different reasons. The US under Donald Trump has, in the name of economic nationalism, launched sweeping global tariff hikes. Europeans are also debating about screening foreign (often Chinese) investments in strategic sectors, to protect national interests. This anti-globalisation turn in wealthy nations often comes wrapped in nativist rhetoric and can veer into xenophobia. But it underscores a real issue: the free-market formula of the past few decades has left many communities – in both rich and poor countries – feeling betrayed by global capital. Factories closed, jobs moved overseas, and those promised ‘spillovers’ and shared benefits often failed to materialise. For developing countries, the stakes in this debate are higher, because it’s not just about jobs – it’s about sovereignty and future growth. If even the US is anxious about who owns its industries, how much more vital is that question for a country that has yet to establish a broad industrial base?

Rather than retreat into narrow economic nationalism or beggar-thy-neighbour trade wars, we can avail ourselves of an opportunity to forge a more inclusive form of globalisation. Progressive political forces should champion a strategic approach that recognises the right of nations, especially poorer ones, to protect and nurture domestic industries even as they participate in global trade and investment. This requires updating international rules to grant developing countries greater independence in managing foreign capital. Governments could be permitted – or even encouraged – to set conditions on foreign investment that ensure technology transfer, local hiring and local sourcing. These policies, maligned by neoclassical orthodoxy as protectionist sins, should instead be viewed as legitimate strategies for building national capabilities, addressing sovereignty concerns, and advancing shared global goals such as climate resilience. A nation that grows on a more equal footing not only empowers its own people but also becomes a more stable and constructive partner in the global system.

What might this look like in practice? First, it means reviving ideas like requiring joint ventures or a minimum use of local resources for production in strategic sectors. It means scrutinising foreign takeovers of key industries and possibly blocking them unless they clearly contribute to national development (for example, by bringing in technology that can’t be obtained otherwise). It also means targeting foreign investment into areas where it complements rather than substitutes for local effort. If a nation wants to build an electric vehicle industry, for instance, it might welcome a foreign battery manufacturer, but under terms that also develop local supply chains and R&D capabilities.

Crucially, managing foreign capital should not be seen as a rejection of globalisation, but as a way to make globalisation work for development rather than against it. We live in an interconnected world facing collective challenges – the climate crisis and the regulation of artificial intelligence, for example – that no nation can solve alone. A more equitable global economy, where developing nations have the industrial base and technological know-how to contribute solutions, is in everyone’s interest. Allowing those nations the space to build that capacity is part of a fair and forward-looking international order. Rich countries, for their part, might reconsider the indiscriminate promotion of deregulation and instead support policies that lead to shared prosperity – even if it means their multinationals face a few more rules when investing abroad.

The debate over foreign investment comes down to who controls the resources, the technology and the decision-making levers in a nation. It comes down to power, autonomy, long-term development and what kind of world we want to build. For too long, many developing nations have ceded control under the promise that growth would happen regardless of ownership. The evidence says otherwise. Economic development depends on building national capabilities, and that means having a measure of sovereignty over one’s economic destiny. Countries that remain merely hosts for other nations’ corporations risk seeing their growth stall out, their hopes of innovation frustrated, and their political autonomy curtailed by the whims of global capital.

Developing nations should rethink the terms of engagement with foreign capital to avoid the ownership trap where reliance on foreign investment today forecloses opportunities for a richer and more developed nation tomorrow. By judiciously managing foreign involvement and fortifying domestic strengths, developing countries can still harness the powerful benefits of globalisation, but in a way that preserves their popular sovereignty and long-term prospects for a more democratic and stable society. The struggle for economic development has always been, in part, a struggle for the freedom to choose one’s own path. Better forms of globalisation expand this freedom, ensuring that integration strengthens domestic capabilities rather than undermining them. By reclaiming that freedom – by reclaiming control – nations of the developing world can chart a more equitable and dynamic path forward, ensuring that globalisation becomes a story of shared progress rather than a tale of perpetual dependency.