If globalisation were to have a meme, the maritime shipping container would be a likely choice. Piled high on the decks of vast oceangoing ships and stacked deep in their holds, these simple steel boxes, typically 40 feet long and eight feet high, emblemise an era in which massive quantities of stuff move around the world at negligible cost. Shoppers everywhere can choose among merchandise in unprecedented variety. Whether they sip a Californian chardonnay or an Australian one, or lace up Indonesian-made running shoes rather than footwear imported from India, the cost of transporting the goods over thousands of miles barely figures into consumers’ decisions about what to buy.

More than 5,000 containerships sail the oceans today, and they are in no danger of vanishing from the scene. But the temporary COVID-19 pandemic-driven boom in trade in goods notwithstanding, the cargo these giant vessels carry is becoming steadily less important as the world economy is reshaped by a new form of globalisation. Over time, globalisation will gradually have less to do with exporting material goods across borders and much more to do with trading services and ideas. This will have important consequences for workers, communities and the health of national economies.

Globalisation itself is not a new phenomenon. Its roots are to be found in an intellectual transformation that began in 1817, when the British financier David Ricardo explained how a country could benefit by importing as well as by exporting. Ricardo dismantled centuries of economic orthodoxy by showing the mercantilist belief that wealth came from importing only raw materials and exporting finished goods to be a fallacy.

As industrial capitalism emerged around 1830, Ricardo’s ideas provided the justification for countries to reduce barriers to imports. With inventions such as the telegraph and the oceangoing steamship providing better information and more reliable connections, foreign trade flourished. So did foreign investment, as European money funded US steel mills, Argentine railroads and South African gold mines. Unprecedented numbers of people moved across borders as well.

In a certain sense, this represented globalisation, although the term was not then in use. But the economic integration of the 19th and early 20th centuries was nothing at all like globalisation as we know it today. For one thing, it was very much centred on Europe, which was responsible for about three-quarters of cross-border commerce and almost all the foreign investment. For another, the vast bulk of international trade involved bulk commodities – coffee, copper, coal – with manufactured goods playing only a minor role.

This first globalisation crashed to a halt with the outbreak of the First World War in 1914. Two world wars and the Great Depression put a damper on international exchange for the next three decades.

In the late 1940s, the victorious Second World War allies sought to restart the global economy by reducing trade barriers and stabilising exchange rates. This second stage of globalisation was driven by round after round of tariff reductions. In addition to the General Agreement on Tariffs and Trade, which was originally signed by 23 countries in 1947 and would later be accepted by dozens more, there were important arrangements to promote trade and investment among small groups of countries, such as the six-country Treaty of Rome that created the European Economic Community in 1957, the seven-country treaty in 1960 establishing the European Free Trade Association, and the 1965 pact that eliminated tariffs on automotive trade between the US and Canada. Freer trade stimulated exports of factory products: in 1957, the world’s exports of manufactured goods equalled, and by 1960 exceeded, those of commodities and raw materials for the first time ever, despite the burgeoning trade in petroleum.

The broad pattern of trade, though, was much like it had been in earlier decades. Manufactured goods, as well as foreign investment, flowed mainly among western Europe, North America and Japan, which had been the wealthiest economies before the Second World War. In the language of the time, these were known as the ‘North’, the ‘centre’ or the ‘developed’ economies, depending upon the political leanings of the speaker. International trade was generally popular in the North through the 1960s, as manufacturers added well-paid factory jobs by the millions.

Exports of raw materials no longer generated sufficient hard currency to service their debts

At the same time, many countries in Asia, Africa and Latin America were barely connected to the world economy. The developing nations of Asia, by one estimate, provided less than 1 per cent of the world’s exports of dry cargo in 1967. Latin American and African countries – the ‘South’ or ‘the periphery’, as they were often called – participated in globalisation from the late 1940s into the 1980s mainly by supplying raw materials to the ‘advanced’ countries, importing their manufactured goods and borrowing their money. Understandably, their governments and their citizens often felt that they were on the losing end of an exploitative relationship. Many countries tried to use foreign borrowings to expand their own manufacturing sectors in hopes of improving productivity and escaping the low-income trap. With very few exceptions, notably South Korea, these efforts did not go well, leaving massive debt burdens and inefficient factories that could not stand up to foreign competition.

By 1979, the US Federal Reserve and other central banks began raising interest rates to choke off rampant inflation. Developing countries with heavy foreign-currency debts felt the squeeze. The eruption of Mexico’s foreign debt crisis in 1982, followed in short order by debt crises in countries from Peru to Poland, abruptly ended the second stage of globalisation. The debt-stricken countries’ exports of raw materials no longer generated sufficient hard currency to service their debts, and for want of dollars they could no longer absorb the rich countries’ manufactured goods. Globalisation – the term was not yet in common use – receded. As a share of the entire world’s economic output, exports fell by a stunning four percentage points between 1980 and 1986, and the flow of foreign money into businesses and factories was choked off. More than 100 countries launched a complex trade negotiation, known as the Uruguay Round, in an attempt to resuscitate international commerce.

Foreign investment picked up in 1986, and international trade followed a year later. These trends were unremarkable; historically, trade usually slowed during tough economic times and rebounded amid prosperity. But while the world’s attention was focused on the collapse of the Soviet Union’s east European empire and then of the Soviet Union itself, the pattern of international trade was evolving in unexpected ways thanks to the confluence of three little-noticed factors.

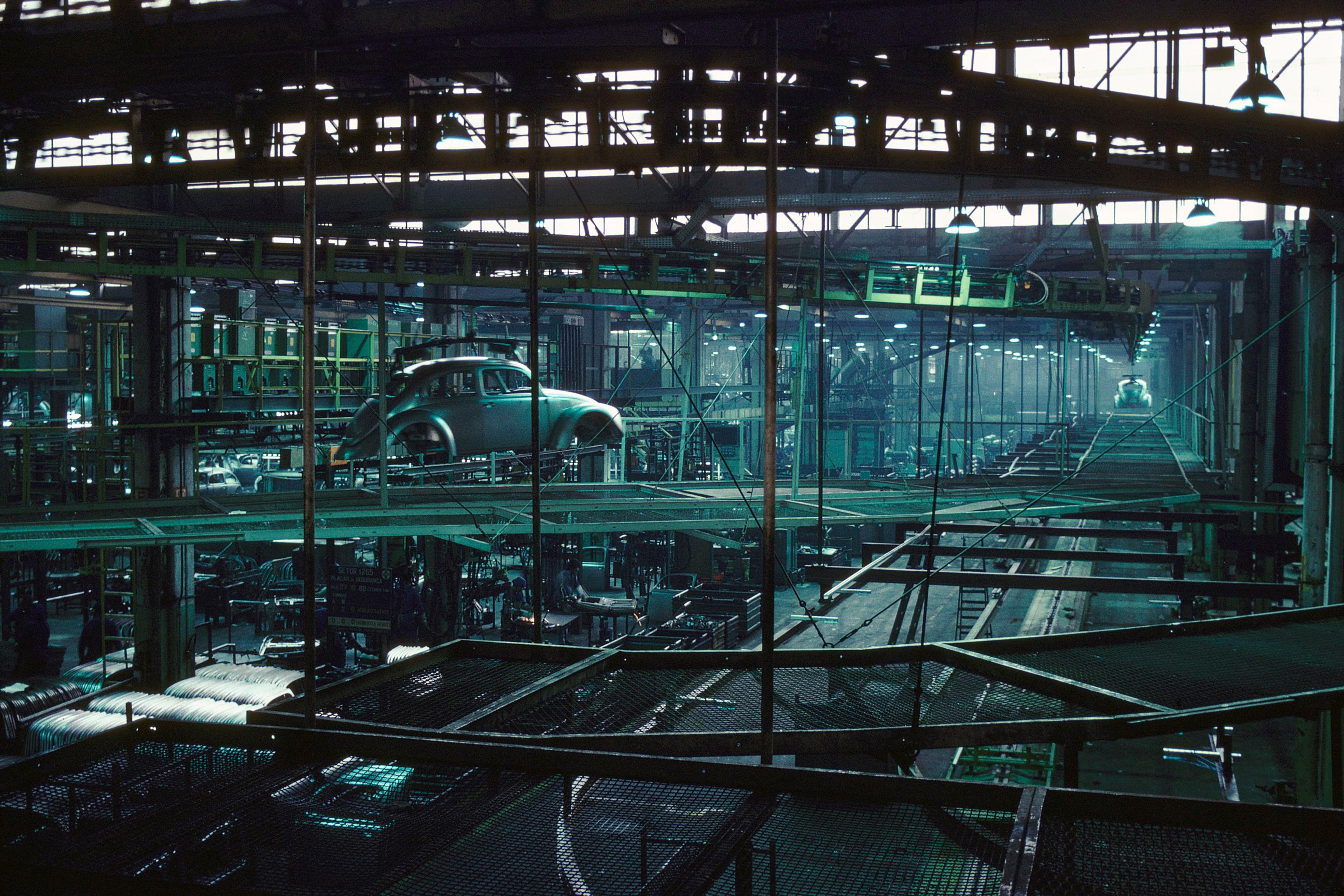

The first of those changes was container shipping. The use of large metal containers to carry freight aboard ships began in the US in 1956, and, by 1977, when service began between Great Britain and South Africa, container ships plied all the major trade routes. After the US deregulated rail freight service in 1980, dedicated trains that carried nothing but containers stacked two-high began moving imports from Los Angeles and Seattle to inland points such as Chicago and Kansas City at very low cost. Containership capacity exploded, growing 29 per cent between 1985 and 1987. Hundreds of companies sprang up to offer door-to-door intermodal service, arranging sea, rail and truck transportation. This was novel: for the first time, shippers could arrange to move their goods from Singapore to St Louis with a single phone call, pay with a single check, and expect their shipment to arrive at the promised time.

The second major change was the dramatic decline in the cost of telecommunications. Historically, international phone calls had been hugely expensive, often several dollars per minute; business communications were usually conducted by telex, a teletypewriter system that functioned well to convey prices and quantities, not to discuss complicated strategic decisions. Thanks to deregulation and new undersea cables, the cost of an international call tumbled, and as it did the number of minutes of international calls from the US tripled between 1980 and 1987. Rates fell even lower after the inauguration of the first fibre-optic cable spanning the Atlantic in 1988 and a similar cable between the US and Japan a year later. Now, corporate headquarters in the wealthy countries could keep tabs on distant subsidiaries and suppliers in a way that had not been possible a decade earlier.

Finally, the cost of computing collapsed during the 1980s. As computers became able to crunch large amounts of data quickly and to display the results on desktop screens rather than on thick printouts, software emerged to oversee logistical arrangements. Now, a company in Chicago could obtain real-time data on the production volumes and inventory levels of a supplier in Hong Kong, enabling it to coordinate overseas activities much more closely than ever before.

These three changes freed companies to make labour-intensive products wherever production and transportation costs were most advantageous, shipping inputs from their home country to be assembled by low-wage workers abroad. Thanks to the elimination of border controls within the European Union (EU) in 1987, the signing of the controversial North American Free Trade Agreement in 1992, and approval of the Uruguay Round agreement among 123 countries in 1994, import tariffs for many goods fell close to zero, freeing most international businesses from worries about how tariffs and import quotas would affect their ability to move goods across borders.

Trade in manufactured goods peaked in 2008. The flow of investment into foreign businesses and factories crashed that same year

These developments transformed the world economy. In the emerging third stage of globalisation, international trade grew twice as fast as global economic output, and manufacturing was at the centre of the story. Factory shipments had accounted for barely half the value of world trade in the early 1980s; by the late 1990s, their share was three-fourths. But as more containers began to clog the world’s docks, an increasing number of them held not finished goods ready for retailers’ shelves, but industrial inputs and components – intermediate goods, economists call them – exported for further processing. By the end of the 1990s, parts and components, from Japanese zippers to be sewn into apparel in China to US-made semiconductors sent for testing and packaging in Malaysia, accounted for 29 per cent of international trade. These long supply chains – and the empty factories and displaced industrial workers they left behind in wealthy countries – came to emblemise globalisation.

Yet while container ships and computers made it feasible for manufacturers and retailers to extend their supply chains to almost any location with good access to a port and a phone line, globalisation was not truly global. Relative to the size of the domestic economy, South Korea’s enthusiastic exporters generated three times the exports of Pakistan and Brazil. A relative handful of lower-wage countries – principally China, Mexico, Turkey, Bangladesh, Vietnam and some east European states – emerged as large-scale producers of manufactured goods for the world market, while in other low-wage countries, especially in Africa, erratic regulations and unreliable power supplies made it impossible for many local factories to survive.

Executives of large companies were transfixed by the savings to be had by shifting production abroad. But hardly any attention was paid to the risks arising from the sheer number of firms that might be involved in any given supply chain. Often, the brand-name company at the top of the chain had little insight into its suppliers’ suppliers, several links below. The bean counters who happily totted up the dollars per item saved by sewing a shirt in Bangladesh or by forging a piston in China usually neglected to adjust their figures for the potential costs if merchandise failed to arrive on time or if a supplier’s conduct tarnished the reputation of the company selling the finished goods.

As a share of the world economy, trade in manufactured goods peaked amid the financial crisis in 2008. The flow of investment into foreign businesses and factories crashed that same year. This abrupt halt to globalisation was uniformly assumed to be temporary; in the past, trade and investment had always rebounded as economic growth picked up. This time around, the pattern was very different. Trade and investment did recover in 2010 and 2011, but then began to underperform. In a dramatic change from the pattern between 1987 and 2008, they were lagging rather than leading the world’s economic growth.

In other words, the form of globalisation that had reshaped the world economy since the late 1980s was waning well before fears about globalisation triggered the 2016 UK vote to withdraw from the EU and the election of Donald Trump as US president a few months later. The raw numbers are worth contemplating. If exports of manufactured goods had accounted for the same share of the world’s total output in 2019 as in 2008, international trade would have been nearly $2 trillion greater. If foreign direct investment had been as important in 2019 as in 2007, an additional $3 trillion would have been pumped into businesses abroad.

The COVID-19 pandemic has given a temporary boost to goods exports as consumers unable to enjoy vacation trips and concert tickets spend on furniture and food processors instead, but the long-term trend is unchanged. It is likely to be the movement of bits and bytes, not metal containers, that will define the next phase of globalisation.

In terms of culture, this shift is already easy to see. With nothing beyond a smartphone at hand, a resident of any country can take in religious ideas, songs in little-spoken languages, and images of everyday life created by amateur videographers half a world away. It no longer seems unusual when fans in China watch an Argentine striker score for an English football club owned by a member of the royal family of Abu Dhabi.

In the economic realm, though, the consequences of this shift will be difficult to measure. This matters. In almost every country, counting exports and imports plays a fundamental role in the politics of trade. Physical symbols have disproportionate importance; politicians routinely make campaign visits to factories that churn out pumps or printing presses, blithely ignoring the reality that the factory’s products rely on imported software or semiconductors. The trade balance between two countries is meaningless when, thanks to global supply chains, much of the value in a country’s exports might come from imported designs, components and marketing concepts, but trade statistics shape the public’s judgment about the health of the domestic economy and the fairness of economic policy nonetheless.

The data on goods trade are far from perfect, but at least customs officials capture information about quantity and value every time a tanker ship enters a port or a truck crosses a border. Some types of services trade also are amenable to data collection. When a Canadian resident purchases a plane ticket on Air France, the payment amount will be registered with precision as a Canadian services import and a French services export. When a Netflix subscriber in Japan watches a Danish movie, a service has crossed borders in a measurable way.

Displaced engineers have no claim to government assistance that goes to displaced factory workers

Many services, though, cannot be readily counted or tracked. Suppose an investment bank in London has its ‘back office’ in Mumbai. When a trader in London purchases a bond, thousands of bytes of data flow from the UK to India, where the bank’s employees obtain confirmation, arrange payment, and maintain records accessible to their colleagues around the world. The data themselves have no value that can be recorded in India’s import statistics. No government records how many bytes flow in either direction, nor the amount of British or Indian labour required to perform the work. So far as government statisticians are concerned, there has been no transaction, so no trade has occurred.

The extent of trade can be even harder to measure when it comes to a Facebook page. The annoying advertising banner that flashes on a user’s screen might have been posted by a server physically located in another country, and the fact that the user clicks on the ad might be recorded by a server in a different country still. These separate transactions both involve advertising services delivered across borders, but neither leaves a trace in any country’s trade statistics.

Amid such uncertainties, whether any community or any group of workers has been left behind amid the growth of services trade will be hard to know. This matters. Where the issue is imports of goods, or another country’s barriers to exports of goods, governments are often at pains to aide domestic workers and industries. With respect to service industries, it will be difficult to do the same.

Every government has identified products and industries that it deems ‘sensitive’ and therefore deserving of special support. Although its average tariffs are extremely low, the US effectively blocks foreign-made pickup trucks by tacking on 25 per cent to the value of every imported pickup. Under international agreements, if a government determines that subsidised imports or imports sold below cost are injuring a domestic industry, it can retaliate with punitive duties on the offending goods; the EU did so in March 2021, raising the price of Chinese-made aluminium products by up to one-third. The standard toolkit also includes combined tariff-rate quotas, such as the Chinese policy that sets a 15 per cent duty on a limited amount of imported sugar but a 50 per cent duty on anything more. Such actions can preserve industries deemed vital to national security, protect important political constituencies from job loss, and dole out favours to friends and families.

None of these measures are suitable for services. When a US manufacturer sends old designs abroad to be converted into modern technical drawings, US tariffs apply only if the drawings are used to make imported merchandise; if the foreign drafting firm simply emails the drawings back to the US, no tariffs apply. If ‘offshoring’ this work eliminates similar engineering jobs in the US, there will be no record that imports were involved. The displaced engineers will have no claim to the sort of government assistance that often goes to displaced factory workers. Preserving jobs, or perhaps an entire workplace, by raising tariffs or slapping a quota on imports of engineering drawings is not a practical option.

Except in transportation, where international air and ship lines might be able to hire crew members from low-wage countries and send maintenance work abroad, the globalisation of services seems not to have displaced many workers to date. One reason could be that the types of service-industry workers whose jobs can most easily be done abroad, from filmmakers to bookkeepers, are more likely than factory workers to have skills that are useful in other types of work.

As the next phase of globalisation develops, it undoubtedly will leave some countries and some communities behind. A place that lacks strong internet connections or a technologically adept labour force has little likelihood of economic success; it’s no wonder that US politicians debating ‘infrastructure’ spend as much time talking up an improved broadband service as better highways. But the fourth globalisation seems less likely to kill off jobs in the service industries of high-wage countries than to hold down wages, as many digital activities can easily be shifted from one place to another if labour-cost differences make it attractive to do so.

This might already be occurring. According to US data, pay in fields such as software publishing, computer programming and graphic design has lagged pay in other types of work, perhaps because it is relatively easy for businesses to shift digital work abroad without workers in their home country noting the consequences. Theft of intellectual property, such as copying music or computer programs without the creator’s permission, might become a more important trade issue than tariff rates or subsidies for steelmakers.

In the 2010s, national leaders, often driven by their own domestic political imperatives, made quick work of disassembling important parts of the edifice that had supported the globalisation of goods trade and investment since the Second World War. They had surprisingly little concern for what would replace it. If a less intense form of globalisation lies ahead, based on services more than on goods, this will require a framework as well. Building it is likely to prove far more difficult than demolishing the structures of the past.