Last year, Ross Gerber, a corporate investment manager, Tweeted a warning about Tesla. Gerber wanted investors to know that Tesla’s success would put other industries ‘at risk’. Which ones? Just oil, internal combustion engine automobiles, car dealers, railroads, auto parts, automobile services, and gas stations. ‘Did I forget some?’ he asked, implying yes, he did. Gerber included hashtags referencing Uber and Netflix as comparable ‘disruptors’. This is why, Gerber implied, there was so much ‘FUD’ (fear, uncertainty and doubt) in the media about Tesla. Gerber suggests a compelling storyline: the underdog hero, Tesla, is up against the evil incumbent forces that will play dirty to defeat it, but Tesla will overcome – just as Netflix and, presumptively, Uber have done.

The Tweet does not substantiate any of this. It doesn’t say why Tesla’s business case is like Netflix’s or Uber’s. It doesn’t say why all the purportedly threatened industries share the same interests here. It doesn’t have to – the human brain does that on its own without any help. As the US literary scholar Jonathan Gottschall has shown in his book The Storytelling Animal (2012), even the faintest sketch of a plotline is enough to prompt our minds to fill in the details. Gerber’s story outline is a familiar enough sketch of David taking on not just one but several Goliaths. It’s a good story outline. But it also ignores many important parts that do not fit with the plucky underdog narrative. It implies that all these alleged Goliaths have the same interest. It’s fiction, fantastically so.

The space between fiction and reality is where economic bubbles take shape. Froth fills that space. Gerber’s vaguely imagined world – one without oil companies, internal combustion engines, rail transportation, auto-service shops, parts makers, car dealers and gas stations – implies a radically different transportation infrastructure. But this future is just one of many possible ones, and storytellers have considered other potentially disruptive forces such as autonomous vehicles, new and different battery technology, or the micro-mobility revolution. How these potentialities play out, and Tesla’s role in them, is not just unknown but unknowable. As the late economic historian Nathan Rosenberg said to one of us: ‘The only thing certain about the future is that it is uncertain.’ Gerber’s Tesla story is fiction – and it is a fiction that relies on many unpredictable and uncontrollable convergent technological forces. To the extent that Tesla’s stock price reflects Gerber’s story, Tesla is a bubble.

As the Dutch Tulipmania of the 17th century and the South Sea Bubble of the 18th century attest, speculative bubbles have been with us since the early days of corporations and market capitalism. Instant mass communication, in the form of the radio, was an amazing invention of the 1920s. Almost 700 new radio stations – the United States’ entire current AM broadcast infrastructure – were established in 1922. But nobody had identified a successful business model for radio broadcast. That March, a small investor, Mrs W C B, sent a letter to the market columnist of the New-York Tribune seeking stock advice:

Question: I am a daily reader of your valued column in the Tribune, and your knowledge on investments has commended itself to me. The great impulse given to wireless telegraphy by the wireless concerts given daily at Newark and elsewhere suggest to me the advisability of making a modest investment in some wireless equipment stock that has potentialities. Could you name a few such stocks that I might invest in with reasonable assurance of large returns later on? What do you think of Radio common?

Mrs W C B had constructed her ‘radio story’ (the term ‘radio’ had yet to completely displace earlier alternatives such as ‘wireless telegraphy’). She correctly understood that the new medium was a powerful means of communication – just as Gerber understands that electric motors are a powerful alternative to internal combustion engines. Mrs W C B’s mind connected the dots from wireless concerts to ‘reasonable assurance of large returns later on’ and manufacturers of ‘wireless equipment’. But this was only one possible future.

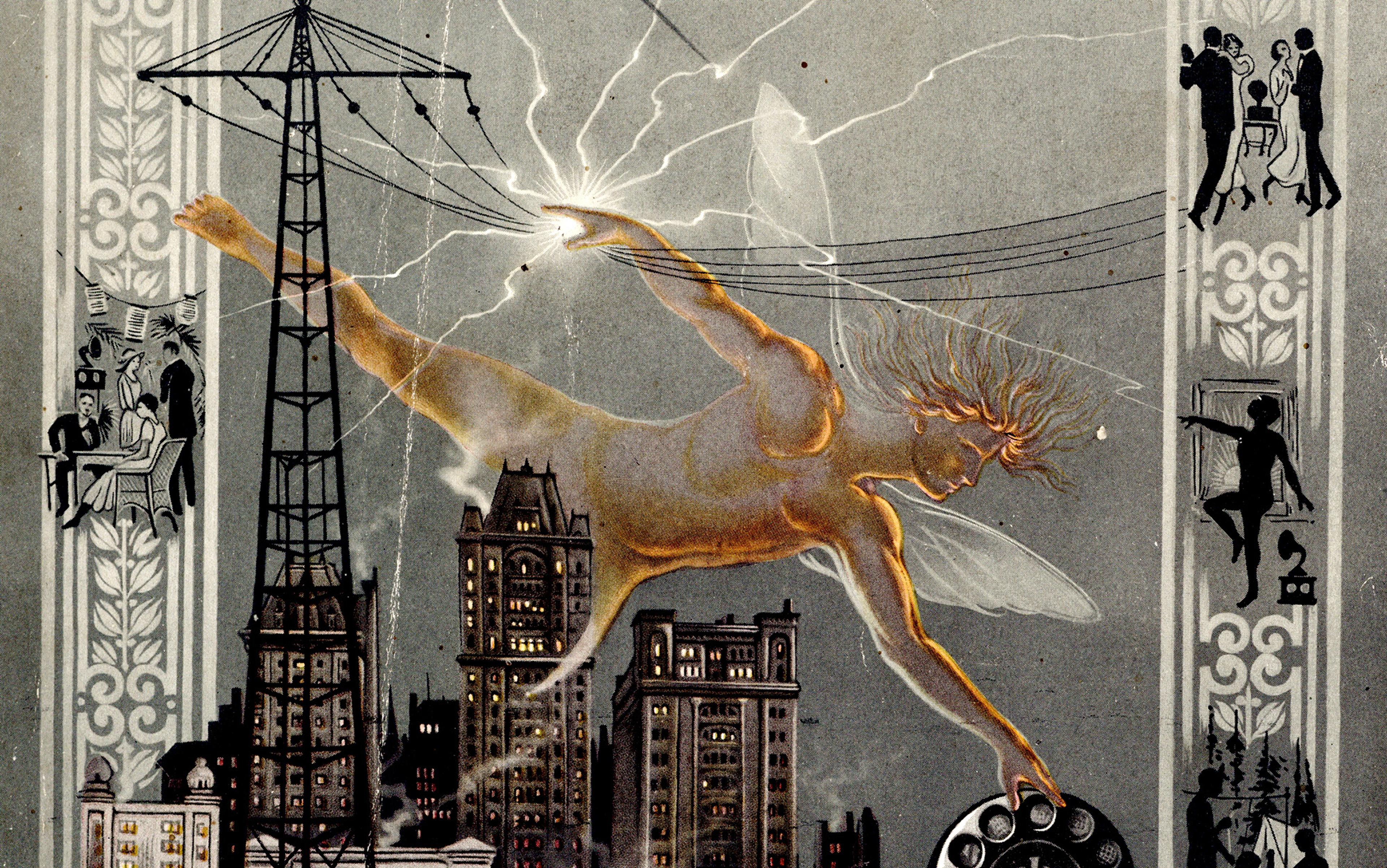

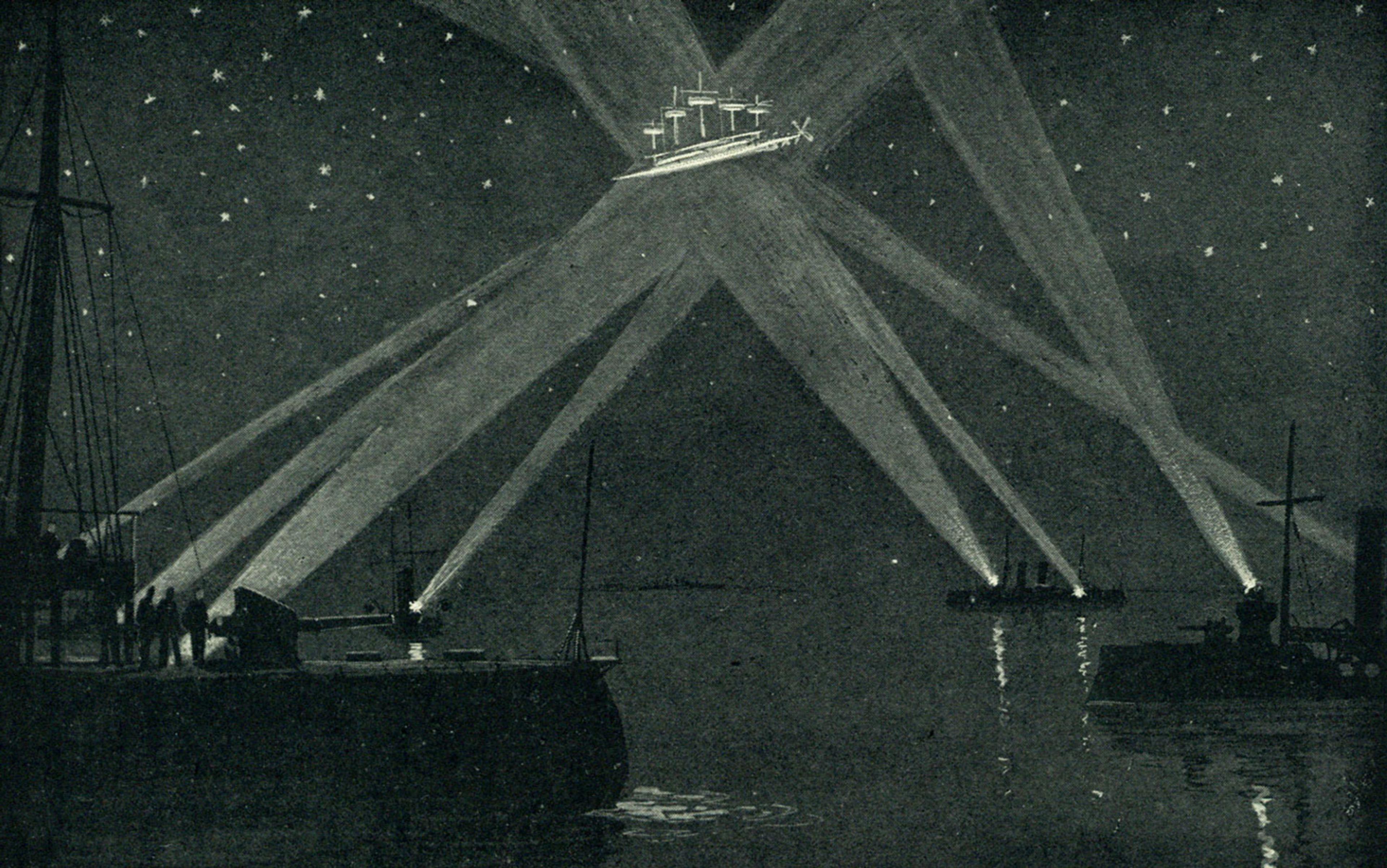

Investors were excited to get a piece of the technology that was broadcasting the Roaring 1920s

Indeed, so uncertain was the radio business that the industry journal Radio Broadcast sponsored an essay competition in 1924 to answer the fundamental question: ‘Who is to pay for radio broadcasting and how?’ More than 800 essays were submitted seeking the $500 prize (more than $7,000 in today’s money). Each essay was its own narrative, a more or less sticky story that an entrepreneur could use to raise money. The US businessman David Sarnoff, who co-founded the Radio Corporation of America (RCA) in 1919, didn’t enter the contest. But he believed that RCA would be able to charge a subscription, just like the telephone company AT&T, despite the fact that it was impossible to know who was tuning in on a radio. There were many possible radio stories available to Mrs W C B, but she wanted to have her story about the future of radio endorsed by the Tribune’s columnist.

Radio common stock was in for quite a ride: in January 1926, RCA shares were trading for $43 on the New York Stock Exchange. Investors were excited to get a piece of the technology that was broadcasting the Roaring 1920s, and join hundreds of entrepreneurs hoping to profit when manufacturers began producing radio sets and related broadcast equipment. They invested in RCA along with the 18 radio-related IPOs that were floated between 1923 and 1926. Three years later, in September 1929, RCA shares cost a bit more, $568. Three years after that, RCA shares had lost 97 per cent of their value and were trading for a mere $15. RCA’s dividend-adjusted price did not recover to 1929 levels for decades. RCA stock – indeed the entire radio sector in 1929 – was not a good investment. If Mrs W C B followed the outline of her own investment thesis and invested in RCA in 1922, we certainly hope she had the good sense to sell well before 1929.

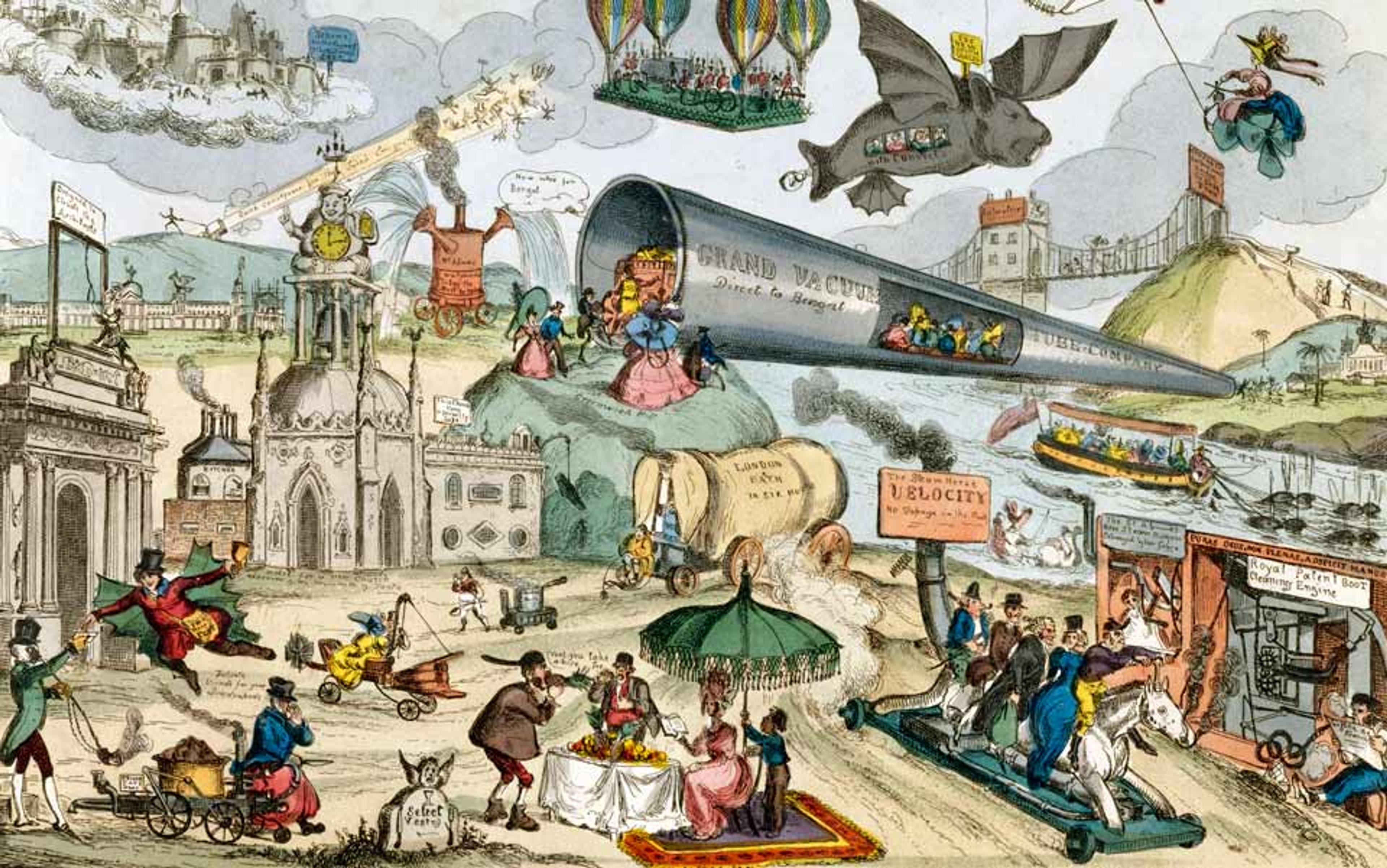

Often the opportunity for a bubble arrives on the back of a new technology. And some technologies make for fantastic stories – indeed, sci-fi is a whole fictional genre based on this premise. Bubbles form whenever a new story is not only told, but can also be sold. However, not every new story leads to a bubble. Sometimes stories can be told, but not sold.

When insulin was first isolated and announced as a treatment for diabetes (again, in 1922), the story was covered by newspapers around the world. Children in diabetic coma, only days from death, were ‘resurrected’ by insulin. Soon, they resumed their normal lives, and insulin was hailed as the ‘resurrection’ cure. This story has an incredible arc: the evil disease is conquered by modern medicine raising children from the dead. Investors might have loved to place a bet on the first miracle of modern medicine, but it was not to be. Eli Lilly and Company, the firm that contracted with the Canadian discoverers of insulin to isolate and distribute the hormone at scale, was privately held. There was no mechanism – no pure play stock – for investors to speculate in insulin. So there was no bubble.

These cases highlight two important necessary conditions for the formation of a bubble: first, bubbles need narratives. Every startup begins as a story about an imagined future. Every venture, every investment, is a statement about the future, an attempt to create a future that conforms to the imagined vision of the promoter. Teams are formed, resources acquired, alliances entered, products and services developed, all in furtherance of that story and that future. Every startup story will have some common elements – a protagonist (sometimes, but not necessarily a technology), a plotline in which the protagonist struggles against a challenge from dark forces (incumbents, or the current way of doing things), and a happy ending where the sun shines and human progress is advanced. Ever incomplete, these stories provide the mental scaffolding for individuals and institutions to invest in new ventures. Good stories sell, and the more uncertain the outcome, the more leeway for entrepreneurs to fabulate. The 800 essays submitted to Radio Broadcast tell us something about how many different radio stories could be told and sold. But insulin had only one story; the intellectual property was clearly demarcated; entrepreneurs couldn’t think of anything else to do with it; all that insulin could do was resurrect the dying.

The story cannot be too fantastic: nobody yet is investing in the promise of teleportation machines

Second, investors must have access to an investment that is closely linked to the object of speculation. The existence of a pure play investment opportunity tells us that at least one entrepreneur was able to concoct a story in which their venture is the hero. While this might seem like a trivial requirement, many important innovations – breakthroughs that might have sparked speculation – didn’t lead to a bubble for the simple reason that investors could not invest in it. Innovations as disparate as Freon, Bakelite, hovercraft, cortisone and drilling for oil were all candidates for speculation where no pure play investment was available. As investors, we can only invest in a subset of opportunities for which pure play narratives can be constructed.

If bubbles reflect the difference between fiction and reality, investors need tools that map this distance. The story cannot be too fantastic: nobody yet is investing in the promise of teleportation machines. But more fantastic visions will lead to more radically imagined futures, ones that displace more of our current economic value chain and, hence, will be more valuable. Entrepreneurial promoters are relentlessly weaving together these storylines in search of backers who will finance efforts towards their realisations. For our book Bubbles and Crashes (2019), we systematically examined 88 different technologies that were candidates for speculation to understand where the line between unbelievable fiction and potentially believable business opportunity lies. Where can froth expand?

Some technologies make for better stories than others because they are more ‘narratible’. They are sufficiently advanced to make the imagined future appear possible, and, if they appeal to things that many of us care about, even better. This makes them sticky, as Chip Heath and Dan Heath put it in their book Made to Stick: Why Some Ideas Survive and Others Die (2007). Human communication is much more interesting to talk about than the design of blast furnaces (steelmaking); the imagined future of electric cars that save the planet is more interesting than the imagined future of automatic transmission that replaces stick shifts. No one wants to have been the person standing on the beach in Kitty Hawk, North Carolina in 1903 saying that powered flight wouldn’t work.

But, in fact, from an investment thesis perspective, that was closer to the truth than not. It would take more than three decades – and hundreds of failed startups – before entrepreneurs could figure out how to make money in the field of aviation. You might not have earned a place of honour in the Smithsonian Institution by passing on aviation in 1903, but you would have had dry powder to invest in telephony or automobiles or any number of other opportunities that panned out sooner. The story of powered flight has been part of human consciousness since the story of Icarus, but the Wright Flyer was not investment grade. Human powered flight was extremely narratible.

Similar predictions haunted collectors of Beanie Babies in the early, heady days of eBay

Our analysis revealed that the investment stories we tell and are told are too simple. Because we are wired to focus on the narrative arc of any given investment pitch, we tend to minimise or ignore the ways that new ideas fail, be they technologies, ventures or simply dreams. The stories we tell each other (and that investments are based upon) oversimplify the world into which that new idea is being introduced. For example, early entrepreneurs and investors failed to understand the interrelated complexities of passenger aircraft design, or how to set up the systems and understandings necessary to sell radio ads or mass-produce electric vehicles. By recovering the background, the context, the complexities attending a new idea, we might be better able to defend ourselves against the pull of the heroic narrative, and recognise that some stories are literally too good to be true. (Competition is one of the most important, yet often ignored, details. Mrs W C B failed to understand that, in the assembly of radio sets, there were few barriers to entry, and little room to differentiate. Once other manufacturers entered the ‘equipment’ market, margins were too slim to make a lot of money in the production of radios.)

Every good story comes to a close, but speculative bubbles are like open books in the sense that we can never be sure when the story will end. Believing that a story is oversold doesn’t tell you when the narrative will unravel. Just 14 days before Black Monday and Black Tuesday, when a 25 per cent market decline in 1929 signalled the start of the Great Crash and the ensuing Great Depression, the esteemed Yale economist and commentator Irving Fisher was certain that the market had reached a ‘permanently high plateau’. Similar predictions haunt all speculative investors, including those who bought tulips in 17th-century Amsterdam and collectors of Beanie Babies in the early, heady days of eBay. While we, as authors, apply our analysis to predict that Tesla’s stock price will fall to Earth, we are unsure when this will happen. And we do also understand that Tesla’s uber-protagonist, Elon Musk, will tirelessly work to shape the story to prevent a Tesla-failure narrative from emerging.

Bubbles inflate as the distance between fiction and reality increases. Contexts – such as investor liquidity, regulatory frameworks and cultural and macro-economic factors – establish boundaries on how far our stories can depart from reality. But entrepreneurs are also creatures of context, and some are better than others at ‘entrepreneuring’, stretching the limits of plausibility and maximising time for their imagined realities to catch up to their promises. Sometimes, we don’t observe a bubble not because the stories aren’t sticky or because the technology isn’t narratible, but because the narrative comes to fruition and the technology or entrepreneur delivers.