‘I’m not absolutely certain of my facts,’ wrote P G Wodehouse in his story ‘Jeeves and the Unbidden Guest’ (1925), ‘but I rather fancy it’s Shakespeare … who says that it’s always just when a fellow is feeling particularly braced with things in general that Fate sneaks up behind him with the bit of lead piping.’

It certainly seems to be the case in science that, just before a field is completely disrupted by a major discovery, someone has to make a statement that sums up the field’s complacency for future historians. For years in the future, people can look at it and think, they had no idea what was about to hit them (and sometimes the lead pipe is used more than once).

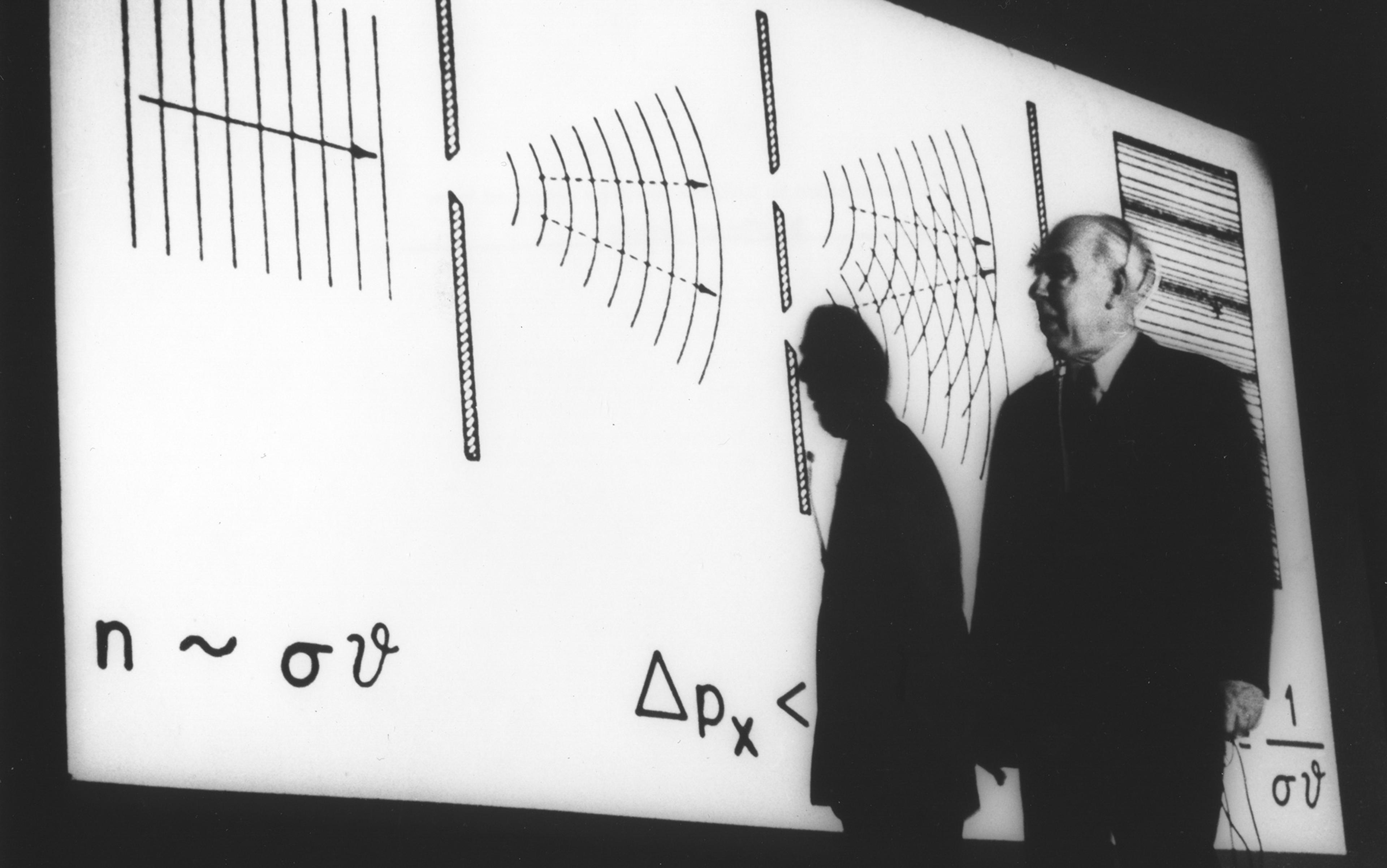

In 1894, this task fell to the American physicist Albert Michelson, later Nobel laureate, when he announced that ‘it seems probable that most of the grand underlying principles have been firmly established, and that further advances are to be sought chiefly in the rigorous application of these principles’. A few years later, those principles were hit by the discovery that, at the subatomic scale at least, nature moves in sudden quantum leaps and jumps.

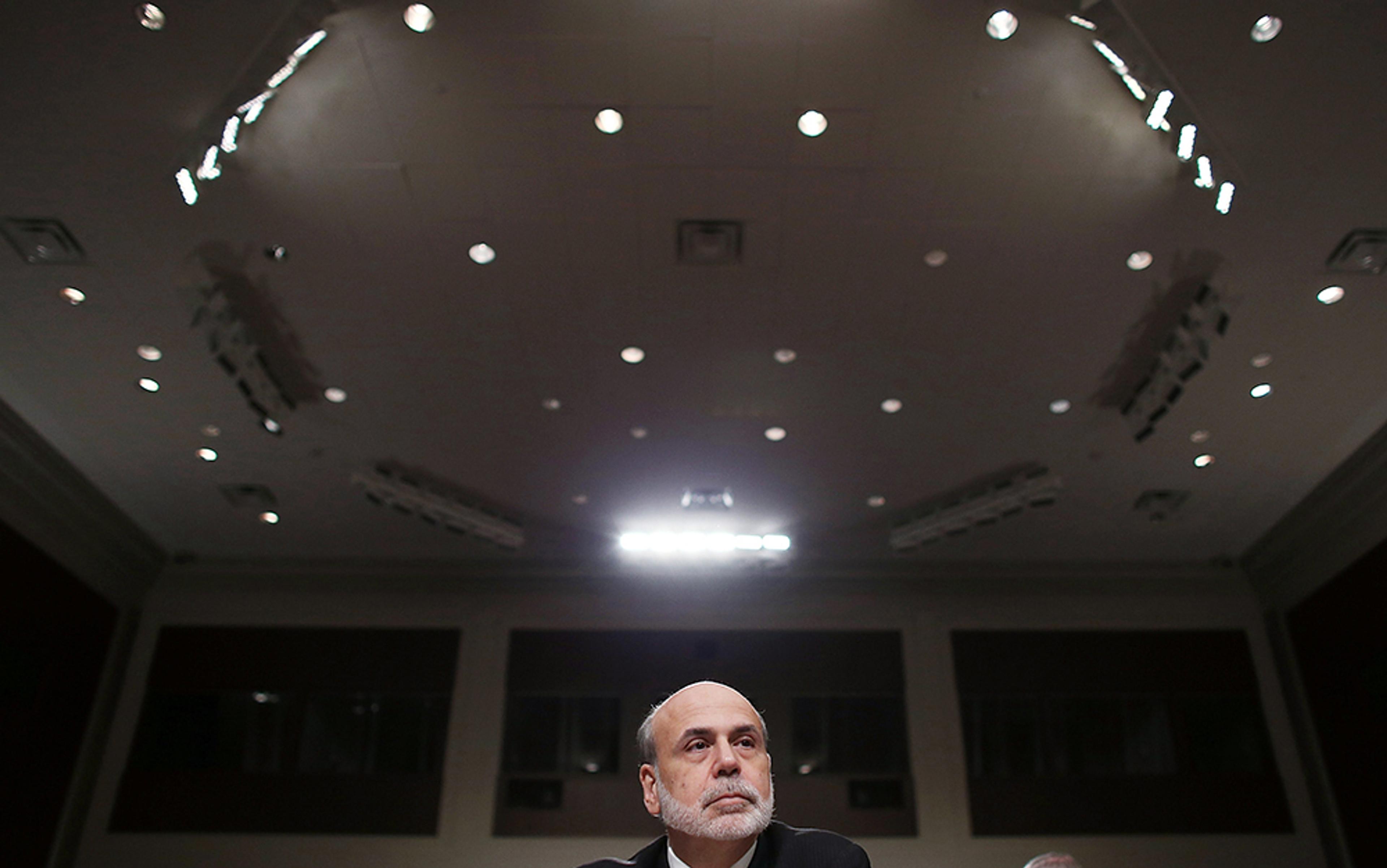

A century on, at the 2003 Presidential Address of the American Economic Association, the job fell to the Nobel laureate, economist Robert E Lucas Jr, who told his audience: ‘My thesis in this lecture is that macroeconomics in this original sense has succeeded: its central problem of depression-prevention has been solved, for all practical purposes, and has in fact been solved for many decades.’ A few years later, that conclusion was shattered by the discovery that the economy had suddenly leaped off a cliff.

Lucas’s optimism was not out of place at the time. With its visions of ‘efficient markets’ and ‘rational expectations’ all firmly grounded in mechanistic equations, economics was the undisputed queen of the social sciences. But the question now is whether history will repeat itself in another sense. In physics, the quantum revolution reshaped the field. Will the financial crash lead to a similar reshaping of economics? After all, mainstream or neoclassical economics is explicitly based on the classical mechanics of the 19th century, with people seen as individual atoms, their behaviour guided by deterministic laws. Surely it is ripe for an update?

Indeed, in recent years there have been many calls for economics to reinvent itself, most noticeably from student groups such as the Post-Crash Economics Society, and Rethinking Economics. In 2017, the United Kingdom’s Economic and Social Research Council announced that it was setting up a network of experts from outside economics whose task it would be to ‘revolutionise’ the field. And there have been countless books on the topic, including my own Economyths (2010), which called for just such an intervention by non-economists.

But progress has been slow. Back in 2008, the French physicist and hedge-fund manager Jean-Philippe Bouchaud wrote the paper ‘Economics Needs a Scientific Revolution’ in the journal Nature. In late 2017, he provided an update to the Financial Times: ‘Following the financial crisis, many of us hoped that the economics profession had finally realised that their models were not representative of how the real economy works, and that their flawed methods would quickly change. That assumption was wrong.’ He concluded that: ‘If we don’t embrace new methods of modelling the economy, we will be as blind to the next crisis as we were to the last one.’

One problem is that, while there have been many demands for a revolution, the exact nature of the revolution is less clear. Critics agree that the foundations of economics are rotten, but there are different views on what should be built in its place. Most think that the field needs more diversity and should be more pluralistic, and feel that the emphasis on economic growth for its own sake needs to be reconciled both with environmental constraints, and fair distribution. Many, including Bouchaud, argue that economists need to adopt techniques from other areas such as complexity theory. There have been attempts to base the subject more on data than on theory. And, of course, the idea of rational economic man – which forms the core of traditional models – should be replaced with something a little more realistic.

But what if the problems with economics run even deeper? What if the traditional approach has hit a wall, and the field needs to be completely reinvented? What if, as with 19th-century physics, the problem comes down to ontology – our entire way of thinking and talking about the economy?

And what if the metaphorical piece of lead piping that mugged both physics and economics was in each case exactly the same thing – namely, quantum reality?

For a start: what is economics? If you ask an economist, or look in a textbook, it turns out that most follow the English economist Lionel Robbins, who wrote in 1932: ‘Economics is the science which studies human behaviour as a relationship between ends and scarce means which have alternative uses.’ Or as it is often paraphrased, economics is the science of scarcity.

And if you ask, what is the point of economics – what is it trying to do? – then the typical answer is to say that economics is about optimising utility. Or as one book put it: ‘Economics is about happiness.’

And finally, if you ask how this is accomplished, you learn that prices correspond to the intersection of supply-and-demand curves, which represent the utility-maximising behaviour of selfish rational consumers and producers, whose homogeneous behaviour is typically modelled using a handful of representative agents, perhaps with various tweaks for ‘bounded rationality’ and so on. The result is a roughly stable and optimal equilibrium.

But something doesn’t add up about these responses. For one thing, if economics is about solving scarcity and making people happy by optimising prices, then it appears to be doing a rather poor job. In many countries, inequality has ballooned in recent decades, while reported happiness levels seem to have peaked some time back in the 1960s. The financial crisis didn’t make many people happy, except some bankers.

The price theory assumes that there exist fixed and independent curves that describe supply and demand, but the reality is that these forces are coupled and in flux – and the idea that they lead to a stable and optimal equilibrium seems more than a little wobbly.

The tenets of mainstream economics are made-up, no more real than Medieval astronomers’ crystalline spheres

Even stranger, though, is that in answering these basic questions money hardly seems to be mentioned – despite the fact that one would think money is at the heart of the subject. (Isn’t economics about money? Aren’t prices set by using money?) If you look at those textbooks, you will find that, while money is used as a metric, and there is some discussion of basic monetary plumbing, money is not considered an important subject in itself. And both money and the role of the financial sector are usually completely missing from economic models, nor do they get paid lip service. One reason central banks couldn’t predict the banking crisis was because their models didn’t include banks.

Economists, it seems, think about money less than most people do: as Mervyn King, the former governor of the Bank of England, observed in 2001: ‘Most economists hold conversations in which the word “money” hardly appears at all.’ For example, the key question of money-creation by private banks, according to the German economist Richard Werner, has been ‘a virtual taboo for the thousands of researchers of the world’s central banks during the past half century’. And then there is the mass of complex financial derivatives, whose nominal value was estimated in 2010 at $1.2 quadrillion, but which is nowhere to be found in conventional models, even though it was at the root of the crisis.

To sum up, the key tenets of mainstream or neoclassical economics – including such things as ‘utility’ or ‘demand curves’ or ‘rational economic man’ – are just made-up inventions, no more real than the crystalline spheres that Medieval astronomers thought suspended the planets. But real things like money are to a remarkable extent ignored.

In physics, the quantum revolution was born when physicists found that at the subatomic level energy was always exchanged in terms of discrete parcels, which they called quanta, from the Latin for ‘how much’. Perhaps we need to follow the quantum lead, and look at transactions between people. In economics, the equivalent would be exchanges of money – like when you go into a shop, point at something, and ask: How much? Or, if you’re in Italy, Quanto?, which makes the connection a little clearer.

Of course, the money objects we use in exchange, such as coins, might not seem to resemble subatomic objects. But look a little harder, and the fields of economics and quantum physics have much in common.

The most basic insight of quantum physics was that matter or energy does not move continuously, but is transmitted in discrete, sudden jumps. Money, of course, is the same – there isn’t a little needle showing the money draining out of your account when you make a payment, it just goes in a single step. And as a Bank of England paper noted in 2015, one reason the money-creation process is hard to accommodate in traditional models is that it works ‘instantaneously and discontinuously’ (their emphasis) rather like the creation of quantum particles out of the void.

In quantum physics, attributes such as position or momentum are fundamentally indeterminate until measured, and according to the uncertainty principle cannot be known beyond a certain precision. Similarly, money’s use in transactions is a way of attaching a number (the price) to the fuzzy and indeterminate notion of value, and therefore acts as a kind of quantum measurement process. When you sell your house, you don’t know exactly how much it is worth or what it will fetch; the price is revealed only at the time of transaction.

One of the more mysterious aspects of quantum physics is that particles can become entangled so that they become a unified system, and a measurement on one affects the other instantaneously. In economics, the information encoded in money is a kind of entanglement device, because its creation always has two sides, debt and credit (for example modern fiat money represents government debt). And its use entangles people with each other and with the system as a whole, as anyone with a loan will know. If you go bankrupt, that immediately affects the state of your creditors, even if they don’t find out straight away.

According to quantum physics, matter is fundamentally dualistic in the sense that it is composed, not of independent, billiard ball-like atoms, but of entities that behave in some ways as ‘virtual’ waves, and in other ways as ‘real’ particles. Neither the particle nor the wave description is complete by itself. This sounds confusing – but the same can be said of money, which is also real and virtual at the same time. For example, a coin is made by pressing a stamp into a metal slug. The stamp specifies the numeric value of the coin, while the metal represents its value as an object that can be owned or exchanged. It therefore lives partly in the virtual world of numbers and mathematics, and partly in the physical world of things and people and value, which is one reason for its perplexing effects on the human psyche.

You don’t need to be an Einstein to know that tapping a credit card initiates a virtual money transfer

Throughout its history, money has alternated between these two sides, presenting either as a virtual system for accounting (clay cuneiforms in ancient Mesopotamia, wooden tally sticks in early Medieval England, electronic money today), or as a treasured thing (Ancient Greece and Rome, the gold standard), while retaining the essential characteristics of each. The dichotomy is also reflected in our two main theories of money: chartalism, which says that money represents a virtual debt to the state; and bullionism, which says it boils down to metal. Most economists ignore the debate and treat money as an inert medium of exchange with no special properties of its own. The situation therefore resembles the old debate about whether light was a virtual wave (Aristotle) or a real particle (Isaac Newton). Eventually, quantum physicists came to the conclusion that light isn’t a particle or a wave, it is both at the same time. Most people didn’t care, and just worried about keeping the lights on, and so it is with money.

It is something of a cliché to say that the discrete, dualistic, entangled and uncertain behaviour of quantum matter challenges every aspect of our commonsense worldview. But it does not seem quite so bizarre or alienating when viewed from an economic perspective – in fact, we deal with it every time we go shopping or cash a cheque. The point is not that quantum mechanics can be viewed as a metaphor for understanding money, but that the economy is a quantum system in its own right, with its own very real versions of measurement, indeterminacy and entanglement. An advantage is that these concepts lack the obscure and confusing nature of their counterparts in physics. You don’t need to be an Albert Einstein or an Erwin Schrödinger or have a degree in quantum mechanics to know that value is uncertain, or to understand that tapping your credit card initiates a virtual money transfer.

The quantum nature of money only comes fully into its own, however, when it interacts with another delicate quantum system – the one that designed it: our brains.

The most disturbing and weird feature of quantum physics, at least for quantum physicists, was that it seemed to hold out a role for consciousness. According to the standard ‘Copenhagen interpretation’, a particle such as an electron is described by a mathematical wave function, whose amplitude at any point describes the probability of finding the electron at that location. This wave function ‘collapses’ to a certain value during the measurement process. No one knows how this collapse occurs, but a conscious observer is usually assumed to be involved, which seemed to undercut the idea of physics as a purely objective science. (It tells you something about science that consciousness – the one thing we all have direct experience of – can be considered disturbing and weird.) It is perhaps unsurprising then that consciousness, and the way that we pattern our thoughts, seems to have much in common with quantum physics.

One of the hottest areas in economics, especially since the crisis, has been behavioural economics, which was founded in the 1970s by the psychologists Daniel Kahneman and Amos Tversky. The most basic lesson of behavioural economics seems to be that making decisions is hard, so we look for shortcuts. And we are easily influenced when someone – the state, an advertiser, our social group, or even our own habits – supplies that shortcut. For example, we prefer to stick with what we know and we dislike change, which explains why investors often cling on to shares that do nothing but go downhill. Recency bias means that we put too much weight on new information – like last year’s investment returns – than older information – such as historical returns. And in general our decisions are shaped by things such as history and context.

However, while behavioural economists can model these effects, they can do so only on a case-by-case basis. And a number of scientists believe that the problem is not so much that people are being irrational; it is just that they are basing their decisions, not on classical logic, but on quantum logic. After all, quantum systems, such as us, are intrinsically uncertain and affected by history and context.

A new kind of economics will point the way to a better, fairer economy. Or at least one less likely to blow up

One person to make this connection was the Pakistani mathematical physicist Asghar Qadir, who pointed out in 1978 that quantum mechanics seems a better fit than classical mechanics to modelling the vagaries of economic behaviour. His paper made few waves, but in the 1990s a number of researchers working in social sciences such as psychology showed how our decision-making at the individual or societal level can be modelled and even predicted using a quantum formalism. This grew into the field of quantum cognition and later quantum social science. As the political scientist Alexander Wendt noted in Quantum Mind and Social Science (2015), the situation is again similar to physics at the start of the 20th century: ‘In both domains rigorous testing of classical theories had produced a string of anomalies; efforts to explain them with new classical models were ad hoc and partial; and then a quantum theory emerged that predicted them all with great precision.’

At the same time, other researchers were applying the quantum formalism to the area of quantitative finance, which is used for modelling the behaviour of financial markets. It turned out that many of the formulas regularly used by ‘quants’ to value derivatives such as options (the right to buy or sell a security for a set price at a future date) could be restated as quantum effects. The Black-Scholes equation, for example, can be expressed as a version of the Schrödinger wave equation from quantum physics. Markets even have their own version of an uncertainty principle (which will come as no surprise to investors).

To date, the focus in quantum finance and quantum cognition has primarily been on reproducing the results of neoclassical or behavioural economics using the methods of quantum physics. Combined with quantum money, though, the result I believe points towards a new kind of economics that will overturn the most basic assumptions of traditional economics, and point the way to a better, fairer and more sustainable economy. Or at least one less likely to blow up.

So how to define this new, quantum-inspired economics? It is not the science of scarcity, and it certainly isn’t the science of happiness (which is not to say these things aren’t important); rather, it can be defined as the study of transactions that involve money. Instead of assuming that market prices represent the intersection of made-up curves and optimise utility, prices are seen as the emergent result of a measurement procedure. Rather than modelling the economy as a kind of efficient machine, it makes more sense to use methods such as complexity theory and network theory that are suited to the study of living systems, and which as mentioned above are now being adopted in economics. One tool is agent-based models, where the economy emerges indirectly from the actions of heterogeneous individuals who are allowed to interact and influence each other’s behaviour, mirroring in some ways the collective dance of quantum particles. Agent-based models have managed to reproduce for example the characteristic boom-bust nature of housing or stock markets, or the effect of people’s expectations on inflation. Meanwhile, network theory can be used to illustrate processes and reveal vulnerabilities in the complex wirings and entanglements of the financial system.

Because it starts from different assumptions and uses different methods than mainstream economics, the quantum version also comes to very different conclusions and predictions. Instead of assuming that market forces drive prices towards a stable equilibrium, it sees the economy as driven by complex feedback loops, including those that affect the creation and destruction of money by private banks. One conclusion is that the risk models currently taught in universities and business schools, and relied upon by businesses and financial institutions, are not fit for purpose (as many guessed after the last crisis).

Instead of rational economic man, who makes decisions selfishly to optimise his personal utility, we have quantum economic person, who is unselfishly entangled with other quantum economic people. Happiness is therefore not a solo pursuit that economists can calculate and optimise. And instead of seeing the economy as a machine devoid of such things as will, volition and personal responsibility – Milton Friedman, for example, wrote in 1953 that economics is ‘in principle independent of any particular ethical position or normative judgments … [It] is, or can be, an “objective” science, in precisely the same sense as any of the physical sciences’ – quantum economics (if we can call it that) sees the economy as a living system where ethics plays an important role. One lesson from the crisis was that economists were heavily implicated in the financial system that they were responsible for regulating, for example through highly paid consulting gigs; as in quantum physics, the observer is never separate from the system.

And while neoclassical economics treats ‘market failures’ such as economic inequality and environmental degradation as aberrations or externalities, from a quantum perspective they appear more to reflect the conflict inherent in money between numeric price and real value, as manifested in a debt-based financial system that prioritises growth above all else. The theory therefore builds on the findings of thinkers such as the English chemist Frederick Soddy (who switched to economics after being awarded a Nobel Prize in 1921 for his work on the basic properties of radiation), the American ecological economist Herman Daly, and many others, who have made similar statements.

A theory is likely to be accepted if it tells a story that benefits a powerful constituency

In fact, many aspects of this quantum economics can be found in so-called ‘heterodox economics’ – ie, theories that don’t fit with the mainstream. And the problems were summed up as long ago as 1926, when John Maynard Keynes – perhaps inspired by the quantum revolution that was then in full swing, or perhaps mindful of that piece of lead piping left on the ground – wrote that: ‘We are faced at every turn with the problems of Organic Unity, of Discreteness, of Discontinuity – the whole is not equal to the sum of the parts, comparisons of quantity fail us, small changes produce large effects, the assumptions of a uniform and homogeneous continuum are not satisfied.’ Conventional mechanistic models can no more incorporate such effects than pre-quantum models of the atom could incorporate quantum effects. Unfortunately, mainstream economists failed to recognise or act on this, but instead remained wedded to their classical approach.

So will the heterodox become the new orthodoxy, and economics go quantum? It would be nice to say that the answer will depend on some impartial test, like the ability to make accurate predictions, but of course this is far from being the case; neoclassical economics has remained in place for a century and a half without much of a predictive track record to boast of (the main achievement of the efficient-market hypothesis was to provide an excuse). Instead, a theory is likely to be accepted if it tells a story that benefits a powerful constituency.

The mainstream mantra that the economy is stable, rational and efficient was perfect PR for the financial sector, so quantum economics can’t compete with that. Its natural constituency is instead similar to that which fuelled the anti-nuclear protests: people – including scientists and non-economists – who have lived through the recent financial crisis, and who want to prevent it from happening again.

Economics, which models itself after 19th-century physics, is clearly due for an update.

But here ‘revolution’ doesn’t seem to be quite the right word, because the revolution already happened a century ago. What we need is a recognition. As Marshall McLuhan wrote in Laws of Media: The New Science (1992): ‘I do not think that philosophers in general have yet come to terms with this declaration from quantum physics: the days of the Universe as Mechanism are over.’ Nowhere is that more true than in economics.