The days of the middle-man are numbered. You can borrow money from peer-to-peer lenders such as Zopa without the bloated intervention of banks; read the news without the patronising control of newspaper editors; and now, through crowdfunding, you can bypass the opaque institutions that control the financing of cancer research and direct world-class medical work.

I first came across the anti-cancer work of Professor Magnus Essand and Dr Justyna Leja by stalking them, on the internet. Five years ago, my co-writer and best friend, the biographer Dido Davies, developed pancreatic neuroendocrine cancer or ‘Steve Jobs Disease’. She had to endure eight hours of gruelling chemotherapy every 21 days, and after sitting with her in the hospital I would come home and scour the web for new treatments.

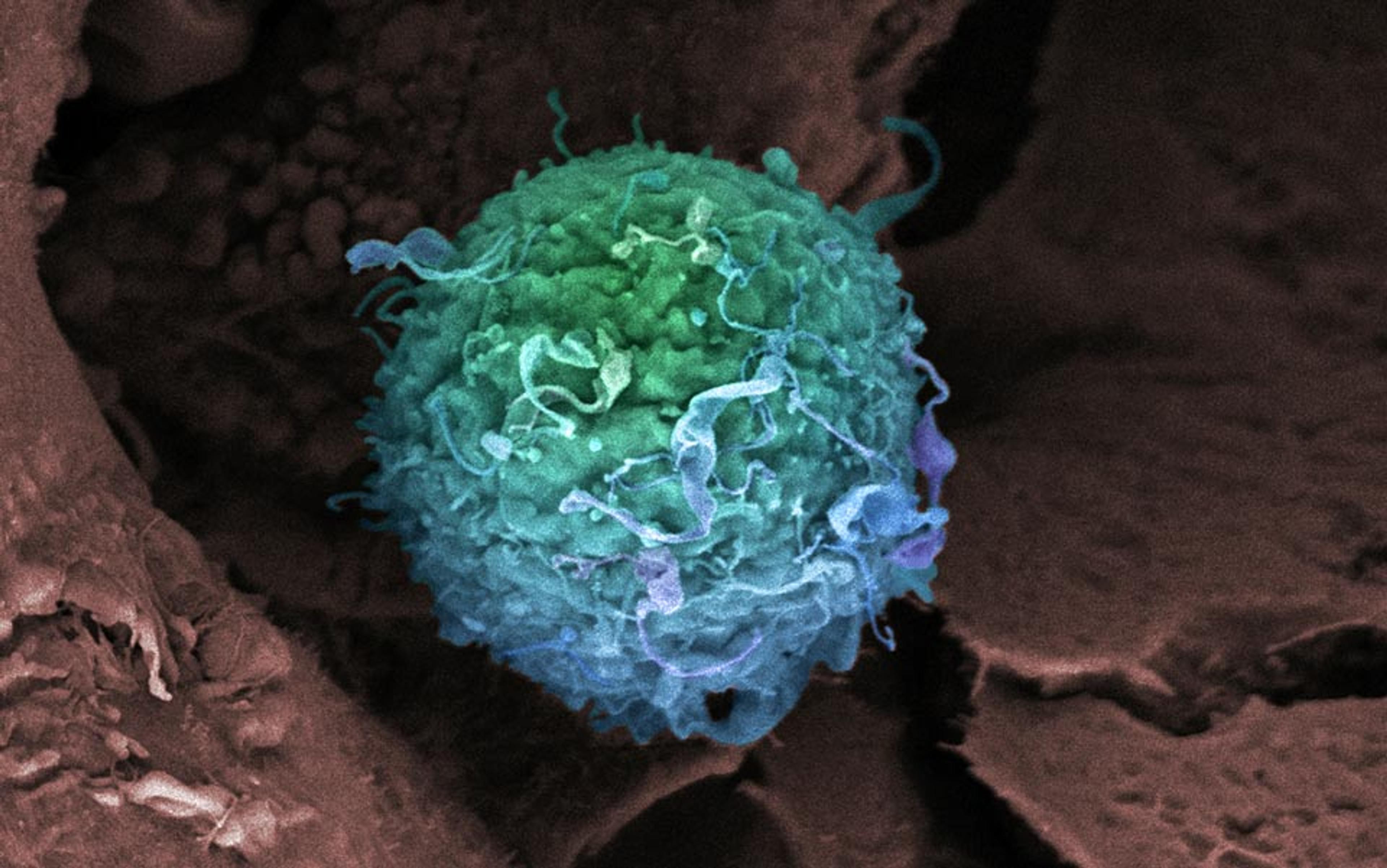

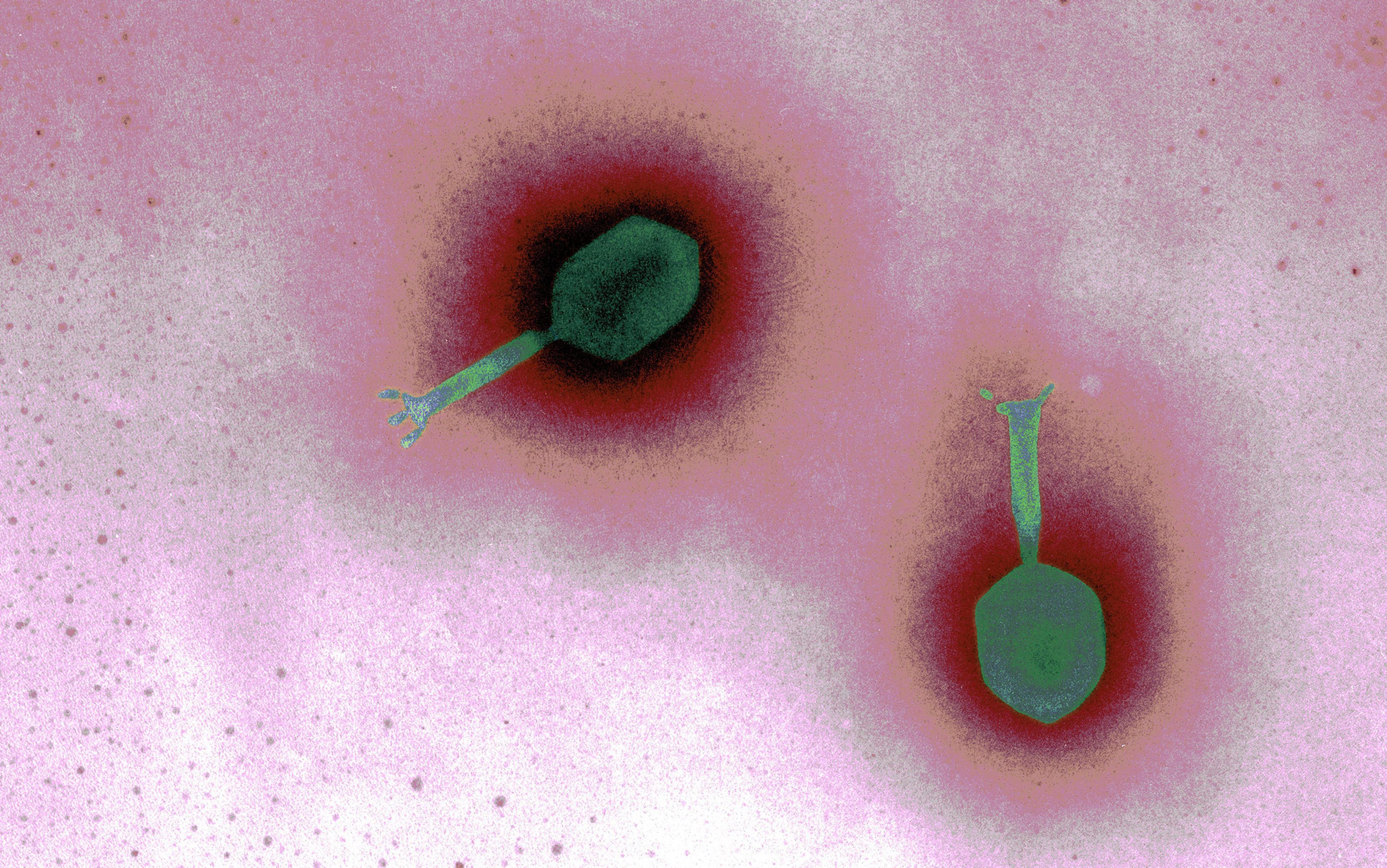

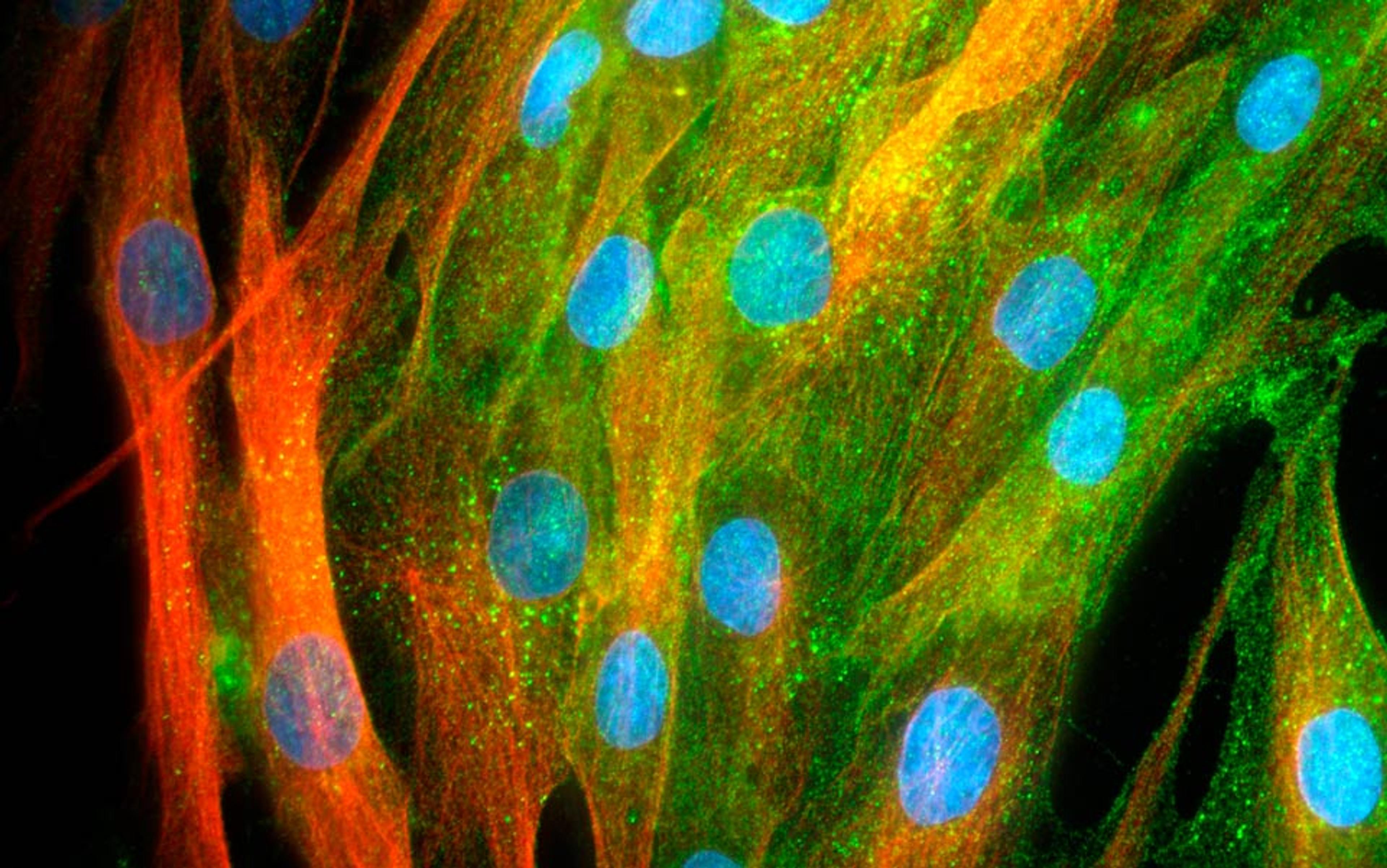

One day, I found something: Ad5[CgA-E1A-miR122]PTD, a ‘cancer-killing’ virus that Essand and Leja had begun developing in 2007 at Uppsala University, 45 miles north of Stockholm. They have been able to use the virus to suppress tumour growth in mice. Cheap to produce, uncannily precise, and with probably only mild, flu-like side-effects, it sounded like the stuff of fable. It was not quackery. Certain viruses, known as oncolytic viruses, have been known to selectively attack and dramatically reduce the size of tumours for some time. But it was not until the middle of the last century that researchers began genetically adapting viruses to seek out specific cancers, and not until 2005 that the first oncolytic virus was approved by a regulatory agency in China (the same virus has failed to be approved in the West).

Uppsala University has been designated a ‘European Centre of Excellence’ by the European Neuroendocrine Tumour Society (ENETS) — the world’s leading professional organisation for this type of disease. Essand is the lead virotherapist at the university’s department of immunology, genetics and pathology: his four papers on the plucky microbe had been published in international peer-reviewed journals of virology and cancer, and the project was endorsed by Professor Kjell Öberg, chairman of ENETS. Yet nobody — neither cancer charities nor government institutions — would finance taking it into human trials.

‘It’s about people voting with their wallet for what people really want, rather than letting the gatekeeper decide what the people should have’

The reasons were four-fold. The Swedish government refuses to fund such research as a matter of policy (human trials are expensive, and the government would rather the money be spent on basic research). Then, although Essand’s modifications to this virus might have therapeutic benefit for a broad range of cancers, the trial was to be specifically targeted at mid-gut neuroendocrine tumours — a comparatively rare cancer type. The EU, reeling as it was with financial catastrophes, had no suitable grants available. Thirdly, clinical trials in some related oncolytic viruses such as ONYX-015 have been disappointing. Finally, Essand’s research wasn’t patented, so no small pharma company could be tempted to bite.

Now, I have no medical or financial expertise, but this seemed absurd to me. Had Steve Jobs not been so curmudgeonly about charitable donations, he could have funded this work himself, for a miniscule percentage of his annual income. Instantly, I Skyped Essand: ‘How much money do you need?’

‘$1.5 million?’ he replied, after a few seconds of calculation. ‘$3 million, to manufacture a really good version and take it into human trials.’

$3 million. Less than Apple earns every seven minutes.

I do not have $3 million. But for just £68 I flew to Uppsala last summer to pester the professor about his work, face to face; and to see this virus, face to petri-dish. Days later, back in the UK, I wrote an outraged article in The Daily Telegraph about neglected lifesaving therapies. The piece was picked up by the Financial Times. Alan Melcher, professor of clinical oncology and biotherapy at the University of Leeds, went on BBC Radio 4’s Today programme to support Essand’s effort. Together with Professor Kevin Harrington, consultant oncologist at the Royal Marsden Hospital, they contacted Essand, confirming his work was ‘cutting edge’ and ‘remarkable’. They even proposed working with him to get the project moving faster. Dominic Nutt, another journalist, who had neuroendocrine cancer himself, and Liz Scarff, who runs a social media company, invited me to help set up a campaign we’d call iCancer to raise money for the virus. We met at the Wetherspoon’s pub at Victoria railway station. That was not expensive either. It cost six pints of beer and a packet of peanuts. And it ended with a possible solution: crowdfunding.

Crowdfunding is a frenetic business. Danae Ringelmann, co-founder of the San Francisco-based global crowdfunding site Indiegogo, had to squeeze in my first telephone interview between several urgent meetings. Her voice was quick and decisive; her language predatory and pioneering. She did not have long. She’d have to ‘grab’ lunch any moment. She had another meeting ‘at the top of the hour’ — which left me 30 minutes to solve not just the existence of a potential new cancer therapy from Sweden, but a worldwide multi-trillion-dollar life-threatening crisis in drug development.

‘Indiegogo was born because of our frustration about how inefficient and unfair fundraising was,’ she told me. With crowdfunding, if you’ve got an idea but no cash to fund it, all you have to do is produce a promotional video, decide on a target amount, and lo! you’re out in the bright open world, hustling — just you and your idea and 7 billion potential donors. ‘It’s about people voting with their wallet for what people really want, rather than letting the gatekeeper decide what the people should have.’ The ‘gatekeeper’ is the image of evil for crowdfunders: ‘If you remove the gatekeeper, the ideas that are truly wanted will bubble up.’ Listen, Ringelmann is saying: can’t you hear the march of meritocracy? Not the patronising forms of representational democracy that usually govern people, but government by the people, for the people, via the wallet: one note, one vote.

The idea is to expel danger with statistics, or at least shoo it into the corridor

‘When we saw your iCancer campaign go up,’ she continued, ‘everyone here at the office took notice because it’s new. It’s paving the way for people to think differently about which drugs should come to market.’ It bypassed the gatekeeper – just as the world’s first citizen science project did in January this year, raising more than $100,000 to sequence the human microbiome. In the case of the Uppsala virus, however, there are two gatekeepers: old-style corporate funding bodies such as large charities and government institutions, with their opaque decision-making processes and clumsy business sense; and the regulatory authorities.

We need people to shout about it!’ exclaimed Sir Michael Rawlins, head of the UK’s National Institute for Health and Clinical Excellence (NICE), when I rang him, his voice fizzing down the phone. ‘We’ve got ourselves into a terrible bind.’ NICE is the ironically named organisation that offers ‘guidance’ to British doctors about which medical treatments offer best value-for-money. If your local hospital refuses to treat your cancer on the grounds that the therapy is too expensive, and saving your life is not sufficiently ‘cost-effective’, it’s because the hospital funding-committee is somewhere in a back room cowering behind a NICE recommendation. This unkindness is not NICE’s fault. It is the result of Sir Michael’s ‘bind’: the ridiculous cost of getting new drugs out of research labs and into patients.

Drug development is now so expensive and so wrapped up in legal complications that it frequently takes a decade and $1 billion for life-saving medication to reach the market. Sir Michael is in no doubt as to who is principally to blame for this abysmal state of affairs: it is not the profiteering of pharmaceutical companies, or the ornateness of modern diseases. It is the ‘completely risk-averse’ attitude of the regulatory authorities.

‘The problem is,’ he told me, ‘every time there’s a drug withdrawal because of safety concerns, particularly in the United States, the poor old commissioner of the FDA [Food and Drug Administration] has to go before Congress and is torn limb from limb, and so the regulatory authorities want more and more and more patients involved in clinical trials before they get to the market.’ The idea is to involve so many people in the testing procedure, that the risk of unforeseen side-effects becomes negligible: to expel danger with statistics, or at least shoo it into the corridor. Of course, the savagery of nature will always creep through now and again; but regulators want to be able to look at those skin-bubbling, bloated victims of statistical outliers and say: ‘You’ve got to admit, we did our best — we could not, statistically speaking, have done more.’

In the 1990s, the average number of patients involved in clinical trials to bring a new drug to market in Britain was 1,500. Now, according to Sir Michael, it’s between 10,000 and 20,000. Regulators today seem less worried about the side effects the patient might suffer, and more concerned with the side-effect of being dismembered by the media if they haven’t immured themselves inside a mountain-range of statistics.

Crowdfunding can’t change the timidity of the FDA and its European equivalent, the European Medicines Agency (EMA). But it can rescue a variety of research-stage medications that are currently being discarded. This is where the second gatekeeper comes in: the biotech companies and other funding bodies that pay to get new drugs through the early stages of clinical trials.

The science behind virotherapy makes sense: offspring viruses released from infected cells infect other cells, becoming, in effect, a cancer of the cancer

Keep your eye on that word ‘early’. There are three stages or ‘phases’ to the typical clinical trial process. A Phase I trial is like an allergy test to determine the safest dose of the new compound: tentatively, in minutely increasing doses, doctors give the medication to 10 or 20 local patients. Phase II trials are for efficacy — to test if the drug works. This requires a larger number of patients, in several medical centres, treated for a longer period of time. If these two, early phase trials are positive, then whoever has funded them starts flinging notices of their success into the air, hoping to catch the eye of a big pharmaceutical company. Nobody but Big Pharma has the resources to fund and coordinate the final, crushingly expensive, randomised double-blind Phase III trial that winkles out every last possible statistical error and bias that might have slipped through earlier trials, and that needs as many patients as a small town.

After visiting Uppsala, I met Dr Mikael von Euler in Stockholm airport. A suave, bendy man with gently accented English that sounds as though he is testing the words like canapés between his teeth, he is on the dark side of medicine: drug production. A former consultant at GlaxoSmithKline and Roche, he is now chief medical officer for Oncos, a small biotech in Helsinki. Until last year, when they stopped the programme, Oncos was the only regulated clinic in the world offering untrialled virus treatments to patients with advanced cancer. The scheme was extremely promising. In five tumour types, Oncos managed to stabilise the tumours in half the patients given up for dead, including a woman who had arrived at the clinic with a 22cm growth in her lung, which prevented her from eating and reduced her breathing to a rasp. Within weeks of virotherapy, the tumour had shrunk by 70 per cent.

There is a powerful feeling among virotherapists that 2013 will be their year: on 10 February, in the journal Nature Medicine, the San Francisco-based biotech company Jennerex reported astounding results with its virus Pexa-Vec against liver cancer — an almost three-fold increase in patients’ average survival times. The science behind virotherapy makes sense: offspring viruses released from infected cells infect other cells, becoming, in effect, a cancer of the cancer. On 19 March, the American Big Pharma behemoth Amgen released the promising results of its Phase III trial of a virus to treat melanoma. The modified herpes simplex virus OncoVex GM-CSF – now renamed Talimogene laherparepvec by Amgen — was originally developed by Robert Coffin, who used to be a virology researcher at University College London. To turn OncoVex GM-CSF into a drug fit for market, Coffin had to set up his own company, leave academic life, and move to the US to be closer to the venture capital and medical networks he needed to run early stage human trials. Does Essand have Coffin’s courage and resolve? At our meeting at Stockholm airport, von Euler of Oncos told me wryly: ‘In order to do what you are asking Magnus [Essand] to do, he will have to change his entire life.’

For Coffin, the gamble paid off. OncoVex GM-CSF shone brightly in Phase I trials and blazed triumphantly in Phase II;. So when the rights to the company’s research went up for sale for the final push through Phase III trials, Amgen snatched it up for $1 billion.

In financial terms, what gets exchanged back and forth in taking a potential therapy from the freezer through the early phases of clinical trials (have you still got your eye on that word ‘early’?) is not the medication, but the patent that awards exclusive rights to investigate the therapy. If you have a patent for something, no one else can legally use it without paying you a good wad of money for the privilege. Without one, your chances of getting a biotech company interested in your compound, no matter how much it fizzes and glows in the test tube, are nil.

Essand does not have a decent patent. In fact, like many research scientists, he deliberately scuppered his chance of getting one for this work, by publishing his results. As soon as ‘A Novel Chromogranin: A Promoter-Driven Oncolytic Adenovirus for Midgut Carcinoid Therapy’ appeared in the journal Clinical Cancer Research, his discoveries became public. After that, it was no longer possible to protect them as intellectual property. Essand’s act of self-sabotage isn’t unusual. Lots of researchers feel that patents are tedious, ill-spirited things that take a long time to process, destroy the free distribution of information, and get in the way of scientific progress. What’s more, they’re expensive. At Uppsala, the researcher, not the university, has to pay for any patent obtained — not just the Swedish one (pointless on its own, since anyone outside Sweden could still pinch the work, perfectly legally), but numerous additional patents to cover every country in the world. These then have to be regularly renewed and rewritten until either the product is sold on at vast profit, or Essand ends up in the homeless shelter.

Without a patent, the only way to raise money for early phase human trials is via charity or government grants. Here the problem isn’t patents, but popularity. If you don’t fit the current funding priorities of these bodies, your potentially revolutionary product withers. Adventurousness is expensive. This is where crowdfunding can step in, although, as far as I know, it has never done so before the iCancer campaign, and some crowdfunding sites such as Kickstarter specifically prohibit projects for medical use. If it works, however, crowdfunding can help rescue an increasingly cash-strapped part of the drug-development process.

Only medications that are highly protected and commercial — the Coca-Cola products of the medical world — can afford to be developed

That said, as soon as a drug has made it to Phase III, the patent problem rears its jealous head once again. Now the gatekeepers are Big Pharma — the only bodies with enough money and organisational reach to run final-stage trials. And if Big Pharma’s gargantuan investment does not have rock-solid protection, it’s not just the potential profits such companies stand to lose when a rival steps in and steals the compound, it’s everything. No patent, and everyone down to the office cleaner risks losing his job. Only medications that are highly protected and commercial — the Coca-Cola products of the medical world — can afford to be developed.

‘There are definitely unpatented drugs out there that have not been developed because nobody has ever found a mechanism to finance them,’ Oncos’s von Euler told me. ‘Not just novel therapies, such as Magnus Essand’s, but also old compounds that have lost their patent protection over time, yet new knowledge shows that there are new uses for them — nobody will fund these products either.’

But, as Sir Michael of NICE points out, there is a possible way around this stage of the patent trap, too. In the US and the EU, any Big Pharma that pushes a new medication through Phase III is automatically granted exclusive rights to sell the new drug for a certain period of time (up to five years in the US, and 11 years in the EU) regardless of the patent status. This extra layer of commercial protection has been introduced because it often takes so long to jump through all the regulatory hoops of a Phase III trial that any patent the drug did have might have run out anyway.

Could this exclusivity agreement also be used, perhaps with a few small adjustments, to protect investment in drugs as yet unpatented? ‘It’s completely out-of-the-box thinking,’ von Euler told me, ‘and totally untested. But if it worked it would be a small-scale revolution. One difficulty is that, at the moment, the exclusivity arrangement comes into effect only when a new drug has been registered, that is, after the Phase III trial has taken place, so the drug is still unprotected during that investment stage. But if it could be made to work, the potential benefits could be very substantial. From a humanitarian point of view, it would be very positive.’

In short, for new drugs without a patent, not-for-profit crowdfunding could bypass one of the main obstacles that keep new work from reaching early phase human trials: the fact that small biotech companies can’t make a cent from such compounds and therefore can’t afford to invest. And, with a bit of encouragement and perhaps some regulatory tweaking, Big Pharma could also take on unpatented compounds, because their profits would be guaranteed by building on an already established exclusivity agreement.

The mere mention of crowdfunding for early stage drug trials on a site such as Indiegogo sends otherwise wonderful — and powerful — charitable organisations such as Cancer Research UK (CRUK) into blubbers of protest. It challenges their hegemony, Indiegogo’s Ringleman would argue, weakens their control of the funding gate. The difference between crowdfunding and the big-charity approach to supporting drug research is that the big charity assumes control. After awarding a grant, the charity takes over the job of filing patents, limiting publications in order to retain control of the product (a very sensible move, enabling it to reinvest any subsequent profits back into the charity for further grant-giving), and guiding the project towards Big Pharma or, occasionally, conducting Phase III trials itself.

Although thousands of patients owe their lives to this highly structured and closely managed approach, such autocratic behaviour isn’t always helpful. According to two professors I spoke to who had worked extensively with such charities (and who wish to remain anonymous), even if Essand had won a grant from a body such as CRUK, chances are it would have been immediately tied up for years with lawyers while they tried to sort out the patent issue.

Ringelmann’s walletocracy of crowdfunding has the potential to move faster, with far less bureaucracy and wasted time, and more clarity. If you want your money to go to a potential therapy for neuroendocrine cancer because that’s what your genius of a co-writer and editor has — then crowdfunding is the best way to ensure it gets there, and only there. Quacks will not thrive if donors with an eye on quality control can see whether the work is based on good research. Each project should provide two levels of clear peer review: it lists the names of the independent experts who back the project as a whole, and provides links to the all-important peer-reviewed journals in which the evidence-based research has been published.

But now the crunch: did crowdfunding work for iCancer? Did we raise the $1 million that was our Indiegogo target?

Yes, perhaps. It’s looking promising.

Indiegogo’s iCancer page closed on 14 February with $161,942 raised. That’s just 16 per cent of our goal, but crowdfunding campaigns do not stand on their own. Liz Scarff, the social media campaigner who coordinated the site (for free), spent much of her time answering emails from people wanting to donate direct to Uppsala University (thus avoiding Indiegogo’s charge of 9 per cent on donations for projects that miss their goal). Through this route, still open, and with money arriving daily from more than 40 countries, the campaign has raised a further $190,000. Finally, the media publicity generated by iCancer has led to three potential private donors who have offered to pay … but, sssh! it’s still at a delicate stage, business meetings are taking place at Uppsala even as I write and the final details aren’t yet in place … let’s just say, it would be more than enough to get the project racing ahead.

This campaign has been running with no budget since last October. Any costs Dominic Nutt, Liz Scarff and I incurred have been met out of our own pockets. ‘It was an experiment, a bloody good one,’ Liz emailed: since our Wetherspoon’s afternoon, our work together has been accomplished entirely online. ‘For the first time in medical history, this campaign brought together a random group of people who each in their own way, online and offline, worked together to raise funds that could take an anti-cancer virus into human trials in six months. And that is bloody marvellous!’

Still, something worries me when I think about this subject in my more fantastical moments. Let’s say we do get all the money for Magnus Essand’s seemingly astonishing virus by crowdfunding, and the drug blazes through its early phase trials demonstrating both safety and efficacy … then what? Do we just stand aside and let some gluttonous Big Pharma company make off with the results (as they have every legal right to do, given the lack of patent), taking the drug through to market, and denying its citizen funders any returns? Wouldn’t it be better if Big Pharma had to pay people back for the money they’d gambled? Wouldn’t people dig deeper in their pockets if their donation bought them some sort of legal ownership of the therapy — something less than a patent, but more than bugger all?

In short, instead of people being mini-altruists (nice of them, but the wrong spirit in which to raise serious money), they become mini-venture capitalists. A market would develop. As therapies got closer to their goals, satisfying certain benchmarks of progress, their ‘shares’ would increase in value; they could be traded. Then, after we’d sold Essand’s virus on to Big Pharma for billions of dollars, and creamed off a percentage or two to buy our own jewel-encrusted swimming pools, we could put the rest of the money back into further life-saving research at Uppsala …

‘That’s not legal,’ said Ringelmann of Indiegogo, before I could get any more carried away. ‘But that is the way the industry is headed. Every year will bring a new story of what crowdfunding can be used for. Last year we funded a baby. Maybe it’s your campaign this year. And next year will be someone going to the moon.’