For 30 to 40 years after the end of the Second World War, Paul Samuelson was one of the best-known economists of all time. His name would have been familiar not just to other economists and students but to readers of The New York Times, The Washington Post and, above all, Newsweek, where he had a regular column for 15 years. In parts of the world, Samuelson’s fame even eclipsed that of John Maynard Keynes, who had been a major public figure as well as an economist.

And yet there is a paradox at the heart of Samuelson’s work. His reputation was based on his mathematical economics – abstract theories that would mean nothing to non-economists. At one point, some of his teachers even thought that he might be unemployable because they doubted whether he could teach ‘normal’ economics students; that is, people who knew less mathematics than he did. However, within a decade of obtaining his doctorate in 1941, Samuelson published an introductory economics textbook that became canonical in part for its success in presenting the subject in an accessible way, quite unlike the dry tomes of his predecessors in both content and appearance.

Samuelson’s Economics: An Introductory Analysis (1948) has gone through 19 editions and been translated into 41 languages. The first 11 editions sold more than 3 million copies. The book uses hardly any mathematics and is full of data about American households, firms, labour unions and government activities. How did an economist whose early reputation derived from his rarefied mathematical skills grow into one of the discipline’s great communicators?

The answer is to be found in the years just before and during the Second World War. At that time, Samuelson, mentored by Alvin Hansen (a professor of economics at Harvard University), began to think about how government spending could be used to make sure that there was never another Great Depression. To understand why the question gripped Samuelson, it is necessary to know a little about who he was, and how he became an economist.

Samuelson was born in 1915 in Gary, Indiana, the second son of immigrants from Suwałki, near the border between Poland and East Prussia. Having made money from a pharmacy business, his parents lost much of it in Florida’s property bubble in the mid-1920s. They moved to Hyde Park, then a predominantly Jewish suburb of Chicago, where they ran a fried chicken restaurant called Plantation Chicken Barbecue. In 1932, Samuelson started as an undergraduate at the University of Chicago, as a commuting student. He was in the first cohort taking the programme instituted by the new principal, Robert Maynard Hutchins, aimed at providing a very broad education. In Hutchins’s curriculum, students took compulsory introductory courses in the physical, biological and social sciences and the humanities, before choosing a focus. Samuelson received what he believed to have been an excellent education, and chose to specialise first in social science and then in economics.

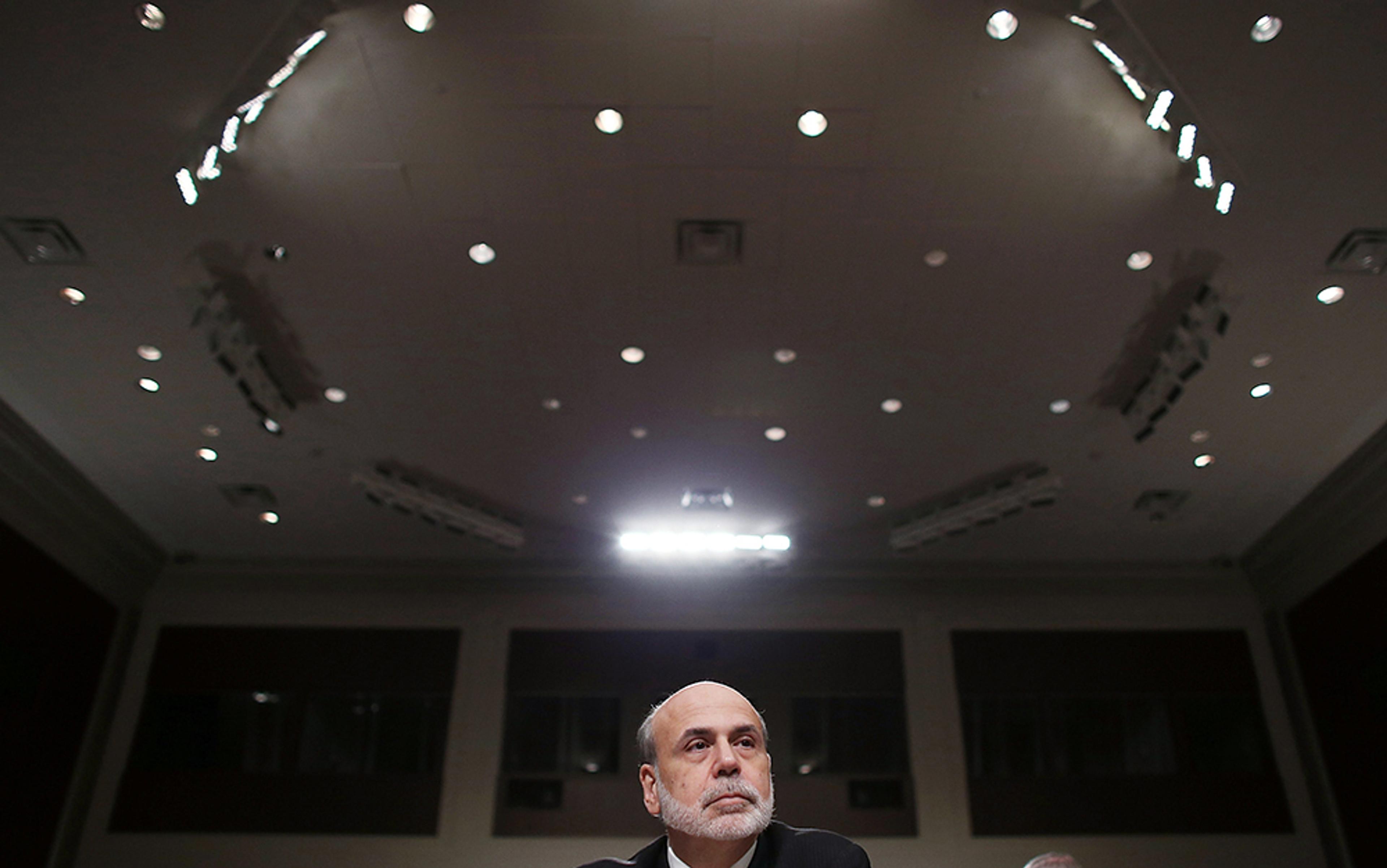

Nobel Laureate Paul A Samuelson. Courtesy the MIT archives

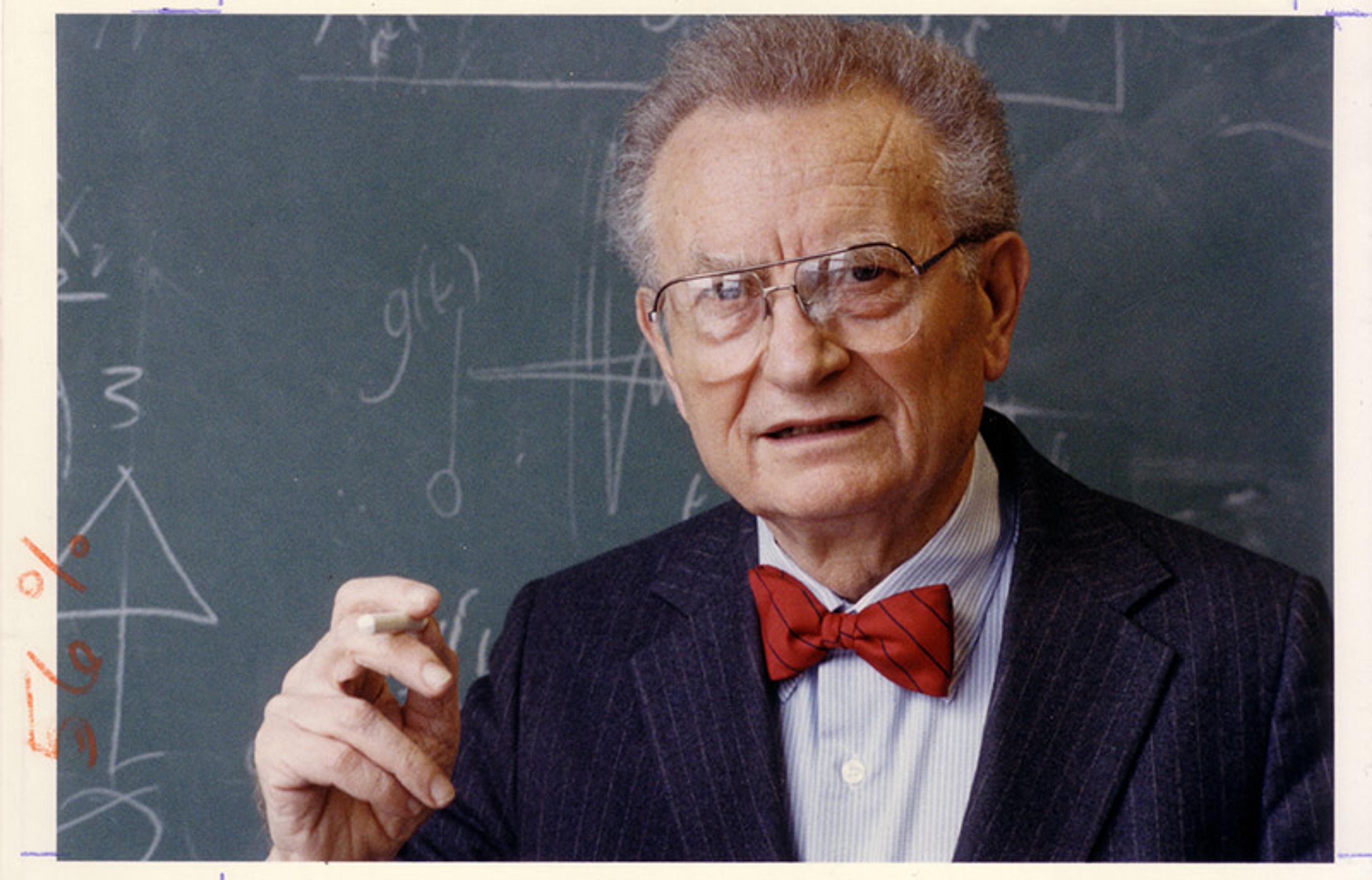

He was a precocious undergraduate, brimming with confidence, who was allowed to take the key graduate course in economic theory. The graduate students alongside him, many of whom were to become significant figures in economics after the Second World War, lived in terror of their teacher, Jacob Viner, whose Socratic method involved asking students questions and operating a three-strikes-and-you’re-out rule. Samuelson, as an undergraduate, had nothing to lose. To his classmates’ delight, he was able to correct the mistakes Viner made drawing complicated diagrams on the blackboard. Samuelson left Chicago with the best training in economic theory any undergraduate could have had at the time.

From Chicago, he went on, in 1935, to graduate school in economics at Harvard, where he encountered the now-legendary figures of Joseph Schumpeter and Wassily Leontief, both émigrés to the US, from Austria and the Soviet Union respectively. However, of greatest importance to Samuelson was the American polymath Edwin Bidwell Wilson, a mathematician, aeronautical engineer, social statistician, economist and managing editor of the Proceedings of the National Academy of Sciences for 50 years. Under the tutelage of these three, Samuelson wrote articles on the theory of the consumer, the theory of the firm, and the theory of international trade. Typically, his articles took a long-recognised economic problem, used algebra to capture the essence of it, and then solved it in a way that made it unnecessary for economists who came after to grapple with the literature that had come before him.

It required stating assumptions precisely and then using algebra to derive implications from those assumptions

In 1940, when Samuelson came to write his doctoral dissertation, he sensed that, although he was studying apparently diverse fields, he kept encountering and solving the same problems over and over. The economics might differ in each subfield, but the mathematical structure of the problems was the same. They were all about choosing the best possible outcome given the constraints facing people. Mathematicians now call it constrained optimisation. For example, a business will aim to make as much profit as possible but has to accept the prices it faces in the market and the technological limitations that determine the inputs required to produce different levels of output. Samuelson tried to put the problem in mathematical terms that could then be applied to different situations in economics.

He attached great importance to the philosophy of science known as ‘operationalism’, developed by the physicist Percy Williams Bridgman at Harvard, whose lectures on thermodynamics Samuelson probably attended. Economic theory was about generating ‘operationally meaningful theorems’, by which he meant theorems that could be confronted with data. For example, it was not enough to discuss, as many economists had done, whether consumers maximised something called ‘utility’ (a measure of how well-off someone is). For such a statement to be meaningful, we must be able to derive and test its consequences. If, for example, economists could show that utility maximisation implied that, when the price of a commodity rose, the quantity a consumer would buy fell, then the theory was operationally meaningful. Prices and quantities bought can be observed and we can see whether the theory is right. The method for deriving such operationally meaningful theorems became known, among economists, as ‘comparative statics’. Comparative statics tells us how, when some variable changes, the whole equilibrium changes. For example, in a model of supply and demand, we can show that if the cost of producing a widget rises by $1, then the price, determined by the equilibrium of supply and demand, will rise by an amount no more than $1 (it could be less than $1). To economists, it sounds an obvious point but it was one that, before Samuelson, no one had made it so forcefully.

When Samuelson published his doctoral dissertation as Foundations of Economic Analysis (1947), it was virtually a how-to manual for economic theory. The book represents a conception of theory, as mathematical modelling, that stood apart from most economic theorising before the Second World War. It required stating assumptions precisely and then using algebra to derive implications from those assumptions. Samuelson was not the only economist working this way – the Econometric Society, formed in 1930, helped to create a substantial community of economists who applied mathematics to economics. But Samuelson’s work did much to promote the general mathematical method.

The approach resonated with the intellectual values of all the economists who had been engaged in technical war work. Like Samuelson, many had worked alongside natural scientists, engineers and mathematicians, before returning to academia in the late-1940s. In the 1950s and ’60s, many economists still pursued theory in the old style, which was less precise yet apparently more realistic and relied on verbal reasoning. But the more mathematics-oriented approach to economic theory that Samuelson represented was rapidly gaining ground. By the 1970s, any graduate student in economics had to get a certain training in mathematics, an expectation very different from that prevailing even a decade earlier. Economic theory had changed, and Samuelson was one of the key figures responsible for that change. The Nobel committee implicitly recognised his role in making economics more quantitative and scientific when they awarded him the Nobel Prize in Economic Sciences in 1970. Symbolic of this change was Samuelson’s move in 1940 from Harvard to the Massachusetts Institute of Technology (MIT), an institution dominated by scientists and engineers, where he spent the rest of his career, until his death in 2009.

Alongside the mathematics genius, there was also another side to Samuelson – a teacher, policy analyst and great communicator. It’s not a common combination, and it grew out of his engagement with public officials and policy advisors. In 1937, Hansen, an economist who specialised in studying business cycles (the succession of booms and slumps experienced by all capitalist economies), took up a chair at Harvard’s newly established Graduate School of Public Administration. Innocent of mathematics, Hansen was a very different type of economist from Schumpeter, Leontief and Wilson. He was committed to policy analysis, with an ongoing connection to the Federal Reserve. Samuelson began attending the Fiscal Policy Seminar run by Hansen and a colleague, John Williams, which brought together academic economists and policymakers, and Hansen soon became his most important mentor. Samuelson’s work with Hansen took off when he used his mathematical knowledge to solve a problem that Hansen had identified relating to his theory of the business cycle. Using a simplified mathematical model, Samuelson wrote two articles considered foundational for postwar business-cycle analysis.

Samuelson started his policy-related work by applying his mathematical tools to the problem of the business cycle. But as he explored further into the subject, he became increasingly concerned with data analysis and conceptual issues related to what Lawrence Klein, Samuelson’s first PhD student, called the Keynesian Revolution. Inspired by the renowned British economist, this involved analysing the behaviour of the economy in terms of aggregates such as gross domestic product, and using interest rates, government spending and taxation to smooth out the business cycle.

Samuelson was one of the first textbook writers to cover discrimination against women and people of colour

Samuelson’s wartime activities proved crucial to his intellectual development. He believed he would fail an army medical examination on account of his high blood pressure, which meant that, in order to avoid being classified ‘medically or morally unfit for military service’, he needed to find an essential civilian occupation. Teaching navy officers at MIT was one such activity, but Hansen also drew him into government service. Samuelson took joint leadership of a project to estimate what the level of consumption was likely to be after the war, a key piece of knowledge, according to Keynesian theory, if the US was to avoid a postwar major depression. This project folded with the closure of the agency in which it was based, but Samuelson took on other consultancy roles with the government. He was working not as a mathematical economist but as an expert on data analysis, in the newly emerging field of national accounting. It would soon come to be known as Keynesian economics. Samuelson also spent much of 1944 working as a mathematician in the MIT Radiation Laboratory, solving technical problems arising out of the use of radar to control gunfire on warships.

After the war, the victorious Allies moved to establish the institutions that would come to dominate international economic relations, such as the International Monetary Fund. In order to avert the threat posed by Soviet communism, the US was also undertaking European reconstruction. Hansen was arguing that it was in the interests of the US to support the rest of the world, and that a retreat from the international stage would be very damaging. Samuelson wrote articles for The New Republic, arguing for a more active US role in the world economy. When the war ended, he resumed teaching at MIT. Virtually all MIT students (most of whom were scientists and engineers) had to take courses in economics, which were very unpopular. Samuelson’s department chair blamed the dry textbook, and gave Samuelson the task of writing something that the students would enjoy reading. One might expect that the author of Foundations of Economic Analysis would have a bias towards mathematics and economic theory, especially at MIT, but Samuelson veered in the other direction. Because the study of economics was designed to broaden the education of MIT students, he decided to take the book away from engineering: to teach them not just to measure and calculate but to write as well.

Samuelson’s Economics (1948) became one of the most influential economics textbooks ever written. New editions have appeared every three to four years for the past 70 years. The legendary textbook adopted a conversational style, one some critics considered to be flippant, and it conveys economic ideas in colloquial ways. It started with household finance – something to which students could easily relate – before going on to companies and the government, and finally linking these sectors through the idea of national income. Samuelson focused on topical issues, and was one of the first textbook writers to cover the problem of discrimination against women and people of colour. As economic problems evolved, he changed the focus, putting great effort into revising the book. Samuelson’s textbook was intellectually, visually and linguistically very far from the dry, theoretical tomes written by earlier generations of authors.

In the 1950s, Samuelson began writing regular appraisals of the US economy for the Financial Times in the UK, and by the end of the decade he was also writing for newspapers in Australia and Japan. In these articles, he assessed what professional forecasters were saying before offering his own analyses. He would discuss problems such as the effects of a steel strike, or whether autoworkers were likely to accept a wage offer and the implications of his prediction. Through his association with Hansen, Samuelson had developed a political commitment, as a liberal and supporter of the Democratic Party. During the 1950s, he was increasingly critical of the economic policies of the Dwight Eisenhower administration, and became one of a group of academics advising the presidential candidate Adlai Stevenson. At the end of 1958, John Kennedy approached Samuelson for economics advice. Samuelson rose to prominence as Kennedy’s adviser when, in 1960-1, he chaired a task force on economic policy that set out priorities for the new administration.

In 1966, a new opportunity presented itself for Samuelson, one to reach his biggest audience yet. The magazine Newsweek made the decision to modernise its economic columns, hiring three economists – Samuelson, Milton Friedman and Henry Wallich (representing Left, Right and centre, respectively) – to write regular columns. For 15 years until 1981, Samuelson wrote a column every third week, covering the state of the economy, personal investing and many other topics.

As an intellectual and economist, there were two Samuelsons. There was the mathematical savant who had learned his trade at the feet of Viner, Leontief, Schumpeter and, above all, Wilson. This work had raised him above most of his contemporaries, enabling him to speak with the authority of one of the leading economists of his generation. However, his more popular work was not just a distillation of his abstract theories; it rested not on complex mathematical arguments but involved careful data analysis and familiarity with the way that economic institutions worked. This was the Samuelson, mentored by Hansen during the Second World War, who wrote Economics and whose views were sought by the press and government.

If Samuelson was right, a portfolio chosen by throwing darts would be as good as professional advice

Samuelson’s journalism came closest to his mathematical economics when he wrote about finance. He and his first wife, Marion, had inherited a small amount of money, and by 1950 he was also earning a very substantial royalty from his textbook. The need to invest these funds encouraged an interest in finance that dated back to his parents’ experience of the Florida housing bubble. Discussions of investment with his high-school mathematics teacher around the time of the Wall Street Crash and the Great Depression also constituted background for his attention to finance.

Then at MIT, there were colleagues with similar interests, some of them engaging in commodity speculation, and the competitive environment encouraged demonstrating that you were smarter than your fellows. Samuelson developed the theory of efficient markets, arguing that, if information is freely available, those involved in buying and selling stocks will take it into account. Prices will reflect all publicly available information, which means that, unless you have information that other people don’t, the only way to make money on the stock market is to be lucky (and you can’t rely on being lucky) or to be smarter than other people, noticing things that they don’t notice, perhaps because you have a better understanding of what is going on. For example, if you have a formula that tells you what a stock option is really worth, while the rest of the market is relying on an inaccurate rule of thumb, you might be able to make a fortune.

The basic idea of efficient markets is simple but there was a lot of resistance to it, especially from brokers and professionals whose reputation for being able to beat the market was at stake. If Samuelson’s theory was right, a portfolio chosen by throwing darts at the financial page of a newspaper would be as good as taking professional advice – unless you lucked out and got an adviser, such as Warren Buffett, who had exceptional talent in picking investments. (Samuelson, an early investor in Buffett’s fund, Berkshire Hathaway, was always intrigued by how Buffett could be so successful.) So proof of the efficient market theory was very important.

In times of economic crisis, people wonder whether economics and economists are to blame. This happened in the 1970s and it happened again in 2008 after the global financial crisis. Because people don’t understand it, mathematical economics of the type Samuelson did so much to develop naturally comes in for criticism as abstract and irrelevant to the world in which we live. What the two sides of his work show is that, like many of the best economists of his generation, he was well aware of the limitations of mathematical theories: that models are simplified and sometimes fail to take into account factors that turn out to be important. He learned what he could from mathematical models and was critical of people who dismissed what they couldn’t understand. However, thanks to his friendship with Hansen and his wartime experiences, he also learned how to tackle economic problems that couldn’t be solved with advanced mathematics. Samuelson’s less rigorous methods involved keeping much closer to what was going on and producing arguments that ordinary people could understand.

Founder of Modern Economics: Paul A Samuelson (Vol I, 2017) by Roger Backhouse is published via Oxford University Press.